ETFs

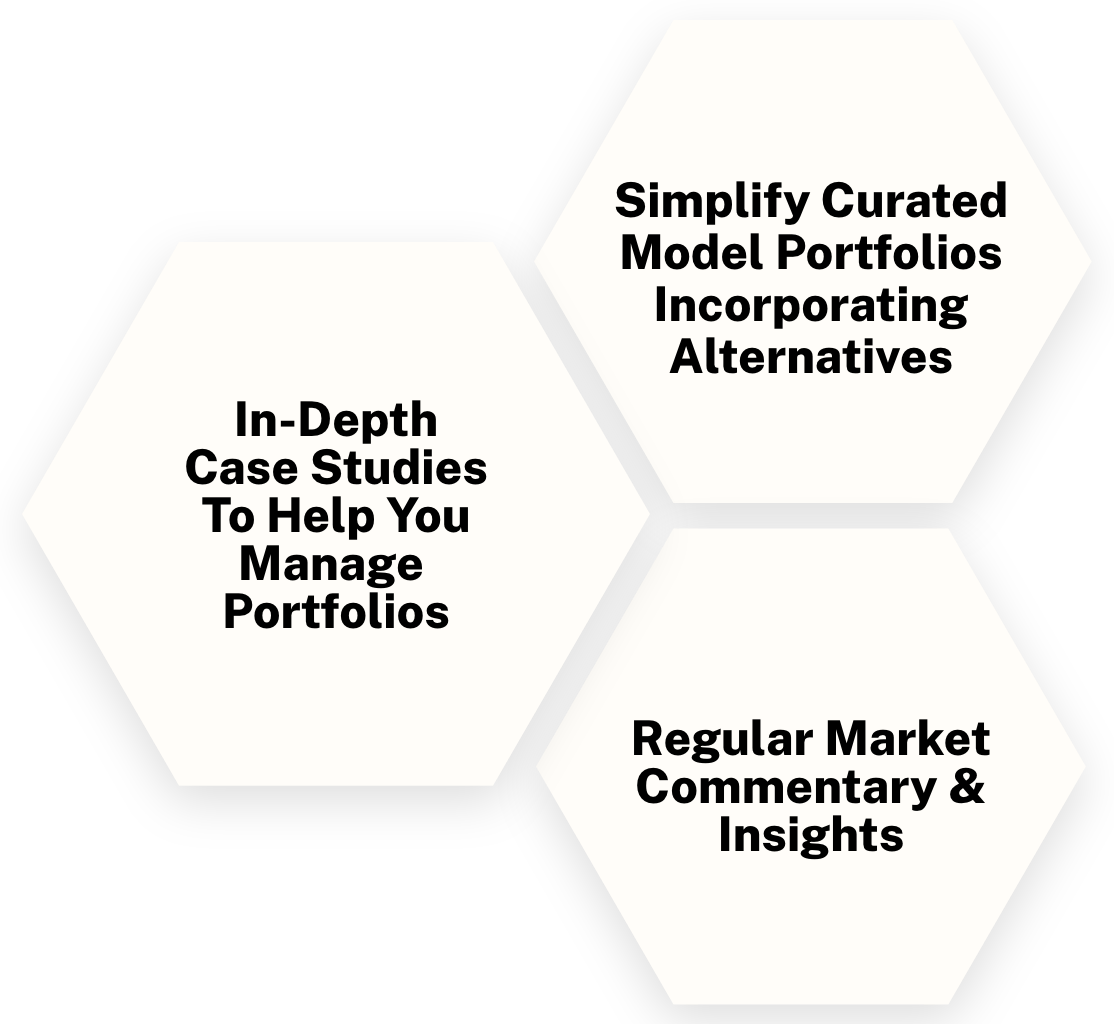

At Simplify, we build innovative portfolio building blocks, designed to directly solve today’s most pressing portfolio challenges.

Our ETF lineup helps asset allocators re-imagine their core equity holdings with convexity, directly and efficiently hedge portfolios against rising interest rates, generate risk-managed income, gain exposure to alternatives, and much, much more.

Our ETF lineup helps asset allocators re-imagine their core equity holdings with convexity, directly and efficiently hedge portfolios against rising interest rates, generate risk-managed income, gain exposure to alternatives, and much, much more.

Opportunistic Bond Investing with CRDT: Less “Fixed,” More “Income”

Read MoreFund Highlights

| Ticker | Title | Asset Class | Category | Net Assets | Inception Date |

|---|---|---|---|---|---|

| MTBA | Simplify MBS ETF 2 | Fixed Income | Mortgages | $1,554,754,354 | |

| CTA | Simplify Managed Futures Strategy ETF | Alternative | Managed Futures | $985,739,530 | |

| SVOL | Simplify Volatility Premium ETF | Equity | Equity Income | $903,202,135 | |

| TUA | Simplify Short Term Treasury Futures Strategy ETF 2 | Fixed Income | Treasuries | $712,770,023 | |

| HEQT | Simplify Hedged Equity ETF 4 | Equity | Hedged Equity | $399,425,874 | |

| BUCK | Simplify Treasury Option Income ETF | Fixed Income | Treasury + Income | $324,416,041 | |

| AGGH | Simplify Aggregate Bond ETF 1 | Fixed Income | Core Bond | $311,788,847 | |

| HIGH | Simplify Enhanced Income ETF | Alternative | Treasury + Income | $187,265,579 | |

| CDX | Simplify High Yield ETF 1 | Fixed Income | High Yield | $166,133,021 | |

| TYA | Simplify Intermediate Term Treasury Futures Strategy ETF 2 | Fixed Income | Treasuries | $153,618,275 | |

| RFIX | Simplify Bond Bull ETF | Fixed Income | Long High Duration | $152,636,212 | |

| PINK | Simplify Health Care ETF | Equity | Healthcare | $135,626,802 | |

| PFIX | Simplify Interest Rate Hedge ETF | Fixed Income | Short High Duration | $128,209,980 | |

| CRDT | Simplify Opportunistic Income ETF | Fixed Income | Credit | $103,805,946 | |

| SPUC | Simplify US Equity PLUS Upside Convexity ETF | Equity | US Large Blend | $97,681,492 | |

| QIS | Simplify Multi-QIS Alternative ETF | Alternative | Cash-Plus | $94,575,247 | |

| NMB | Simplify National Muni Bond ETF | Fixed Income | Municipal Bonds | $85,437,141 | |

| SPD | Simplify US Equity PLUS Downside Convexity ETF | Equity | US Large Blend | $69,552,303 | |

| SURI | Simplify Propel Opportunities ETF 7 | Equity | Biotech | $59,908,571 | |

| SPYC | Simplify US Equity PLUS Convexity ETF | Equity | US Large Blend | $58,234,762 | |

| MAXI | Simplify Bitcoin Strategy PLUS Income ETF | Alternative | Bitcoin + Income | $40,570,109 | |

| HARD | Simplify Commodities Strategy No K-1 ETF | Alternative | Commodities | $37,933,394 | |

| SPBC | Simplify US Equity PLUS Bitcoin Strategy ETF | Equity | US Large Blend + Bitcoin | $26,453,414 | |

| YGLD | Simplify Gold Strategy PLUS Income ETF | Alternative | Gold + Income | $26,095,928 | |

| WUSA | Simplify Wolfe US Equity 150/50 ETF | Equity | Equity Long/Short | $23,039,840 | |

| TESL | Simplify Volt TSLA Revolution ETF | Equity | Concentrated Thematic | $17,833,477 | |

| FOXY | Simplify Currency Strategy ETF | Alternative | Currency | $13,920,161 | |

| GAEM | Simplify Gamma Emerging Market Bond ETF 6 | Fixed Income | Emerging Markets | $11,114,867 | |

| FIG | Simplify Macro Strategy ETF 3 | Alternative | Multi-Asset | $11,023,317 | |

| CAS | Simplify China A Shares PLUS Income ETF | Equity | Emerging Markets | $9,845,469 | |

| IOPP | Simplify Tara India Opportunities ETF 5 | Equity | Emerging Markets | $8,661,815 | |

| EQLS | Simplify Market Neutral Equity Long/Short ETF | Alternative | Equity Long/Short | $4,986,784 | |

| SBAR | Simplify Barrier Income ETF | Alternative | Barrier Income | $2,500,025 | |

| XV | Simplify Target 15 Distribution ETF | Alternative | Barrier Income | $2,500,025 | |

| SCY | Simplify US Small Cap PLUS Income ETF | Equity | US Small Cap + Income | $2,420,109 | |

| SPQ | Simplify US Equity PLUS QIS ETF | Equity | Equity + QIS | $2,310,618 | |

| NXTI | Simplify NEXT Intangible Core Index ETF | Equity | US Large Blend | $1,343,359 | |

| NXTV | Simplify NEXT Intangible Value Index ETF | Equity | US Large Value | $1,196,756 |