Introduction

China’s economic and stock market heft make it difficult to ignore in a globally diversified equity portfolio. At the same time, the market is characterized by a combination of operational, analytical, and regulatory challenges. Many investors have responded by either avoiding Chinese equities entirely or taking their equity exposure passively.

However, China’s unique market dynamics lend themselves neatly to a more structural approach which the Simplify China A Shares PLUS Income ETF (CAS) has been designed to take advantage of. CAS aims to capitalize on these underappreciated nuances to produce a more attractive and more consistent return profile compared to either active stock picking or stock-based passive strategies.

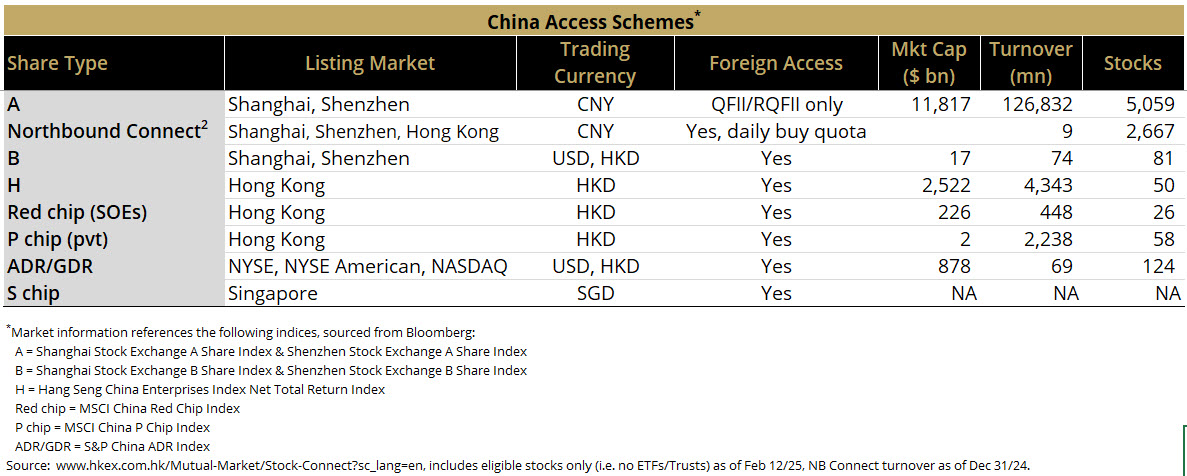

China Offers an Alphabet of Share Types

China confronts investors with numerous challenges. For starters, merely accessing Chinese equities can be tough for non-residents of the Mainland. There are various schemes for doing so: RMB Qualified Foreign Institutional Investor (RQFII) / Qualified Foreign Institutional Investor (QFII) programs which allow foreign institutional investors direct access to A share listings onshore, H shares listed in Hong Kong, S shares listed in Singapore, Northbound Connect through Hong Kong, American Depository Reports (ADRs) and Global Repository Reports (GDRs) listed on the US and other G10 exchanges, and a few others. Figure 1 below summarizes some of the options.

Figure 1: China Access Schemes

Among the plethora of choices, a few things stand out. The A share listings dominate the opportunity set. These are companies which are incorporated in China and listed and traded on the main domestic exchanges in Shanghai and Shenzhen. The over 5,000 names and nearly $12 trillion of market capitalization dwarf the combined 134 names and $4.4 billion across the H share, Red chip, and P chip listings of companies incorporated in China, but listed in Hong Kong.

The A shares are also the undisputed center of the action when it comes to trading activity with 136 billion shares changing hands or more than twenty times the volume of all the Hong Kong-listed share types combined.

The other notable feature is the limited uptake of the Northbound Connect scheme which facilitates foreign investor access to A share listings through Hong Kong.1 While over half of the A share listings are available to offshore investors through this point-of-entry, the turnover has been extremely low. Moreover, while aggregate foreign ownership is limited to 30% per name, for all but 31 individual stocks, foreign holdings through the Connect scheme are less than 10%.

Returns Vary Across Access Points…and by a lot

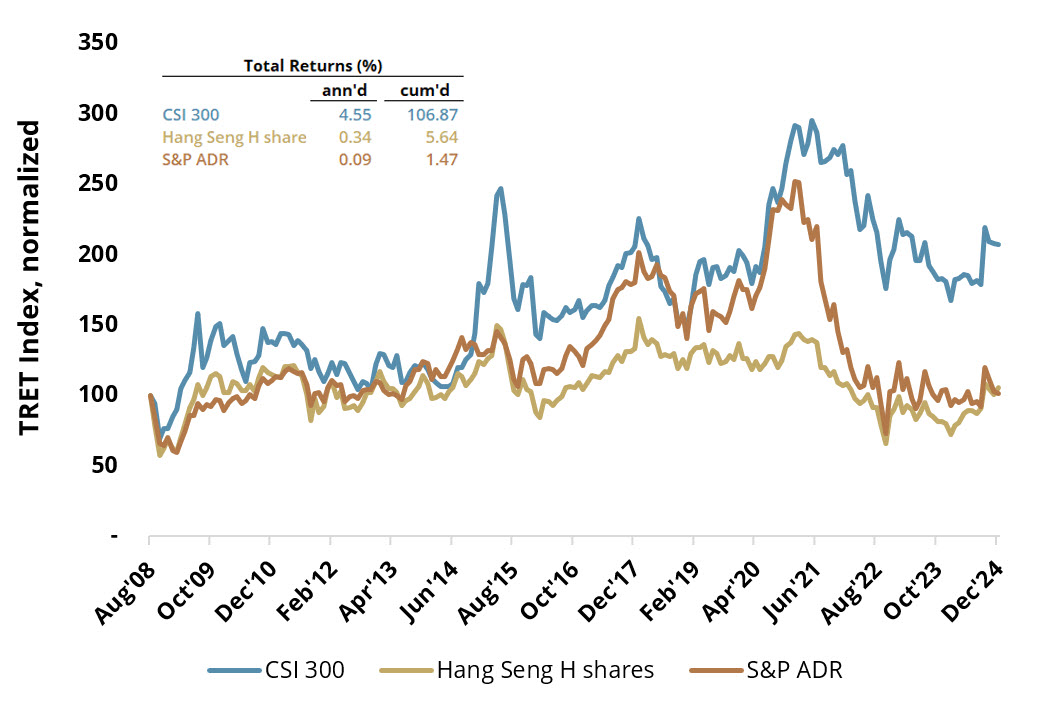

Having some appreciation for the operational considerations, it might also be helpful to look at how these different access points stack up from a risk and return perspective. Figure 2 shows returns for the main A share index (known as the CSI 300 Index), the Hang Seng H share Index in Hong Kong, and the S&P China ADR Index, all normalized to the common period of the indices.

Figure 2: China Access Points Comparison

Sept 08 - Dec 24

The table within Figure 2 shows this outperformance numerically: the A shares’ 4.0%-plus annualized pickup versus H shares and ADRs has led to striking differences in cumulative return over the 16-plus years shown in the chart. The conclusion seems clear: going onshore has produced a meaningful total return advantage over the period shown. And it has done so without exhibiting much incremental volatility which, for the three indices, has ranged between 26.0% and 28.5%. The size of the return gap also provides investors some enticement to expend the resources—time, money, and likely a bit of frustration—to obtain A share access.

Beyond Selecting a Market, Selecting Stocks Is Also Tough

Notably, obtaining access is merely the ante to play in China’s A share markets. An investor still needs to place bets. And this presents its own set of challenges.

The CSI 300 Index cited above contains [unsurprisingly] 300 names although the CSI has 500, 1,000, and 2,000 variants, each capturing a progressively smaller set of market capitalizations. So, from the 5,000-plus A share listings noted earlier, 3,800 seems like a practical ceiling for an institutional investor using QFII to get onshore. For investors (either individual or institutional) accessing the A share market through Northbound Connect, that ceiling would currently be ~2,700 names. For a traditional fundamentals-based stock picker, this would require research coverage capability at least on par with what one might expect from an active manager trafficking in the all-cap U.S. market. This is a herculean ask of even a well-resourced firm, let alone an individual investor.

Beyond resources, there are a couple of other challenges to flag. Reported financials may — at least to foreign eyes — lack the transparency investors are accustomed to in G10 markets, further complicating stock selection efforts. Moreover, China’s industrial policy — itself a reflection of the government’s priorities — can also exert an influence. Thus, maintaining a grasp on the economic situation and domestic political dynamic is an integral part of a stock selection-based approach.

Perhaps because of the combination of all these operational and investment challenges, most investors who want a dedicated China allocation seem to have eschewed all of these decisions and prefer taking their exposure passively. A quick Bloomberg search suggests that the assets of passive China-focused ETFs exceed those of actively managed products, both ETFs and mutual funds.

However, active management does have a role to play here, though perhaps not in the way most investors would expect. CAS aims to deliver the benefits of such an active approach to clients.

Stopping Short[ing]

One of China’s peculiarities is the inability of domestic investors to short stocks. By regulation, it is simply not permitted. However, the demand to short stocks is significant. Banks accommodate this demand by maintaining sizable inventories of stocks. These stocks can then be used to meet demand for shorting synthetically. Simultaneously, banks also want to hedge the long stock positions which remain on their books. And they are willing to pay very favorable financing rates to investors who will take the long side of these stocks.

In practice, this is achieved by entering into a total return swap (TRS). This is an instrument typically accessible only by hedge funds and institutional investors. However, Simplify has agreements with major global banks that are members of the International Swaps and Derivatives Association (the agreements are referred to as ISDAs), allowing Simplify to utilize tools like this and to take advantage of their benefits for investors.

Figure 3 illustrates the China TRS. Starting from the left, an investor earns the performance of the underlying stock index (assumed to be the CSI 300 Index here) and that performance is earned in USD. And as with any swap, the investor pays the funding rate. But because the banks are motivated to hedge their exposure — motivated enough that they will share what amounts to their stock lending revenue — the number in the funding cost box is negative. Putting all this together, a TRS facilitates taking exposure to China onshore equities and getting paid to take that exposure.

Figure 3: Total Return Swap Components

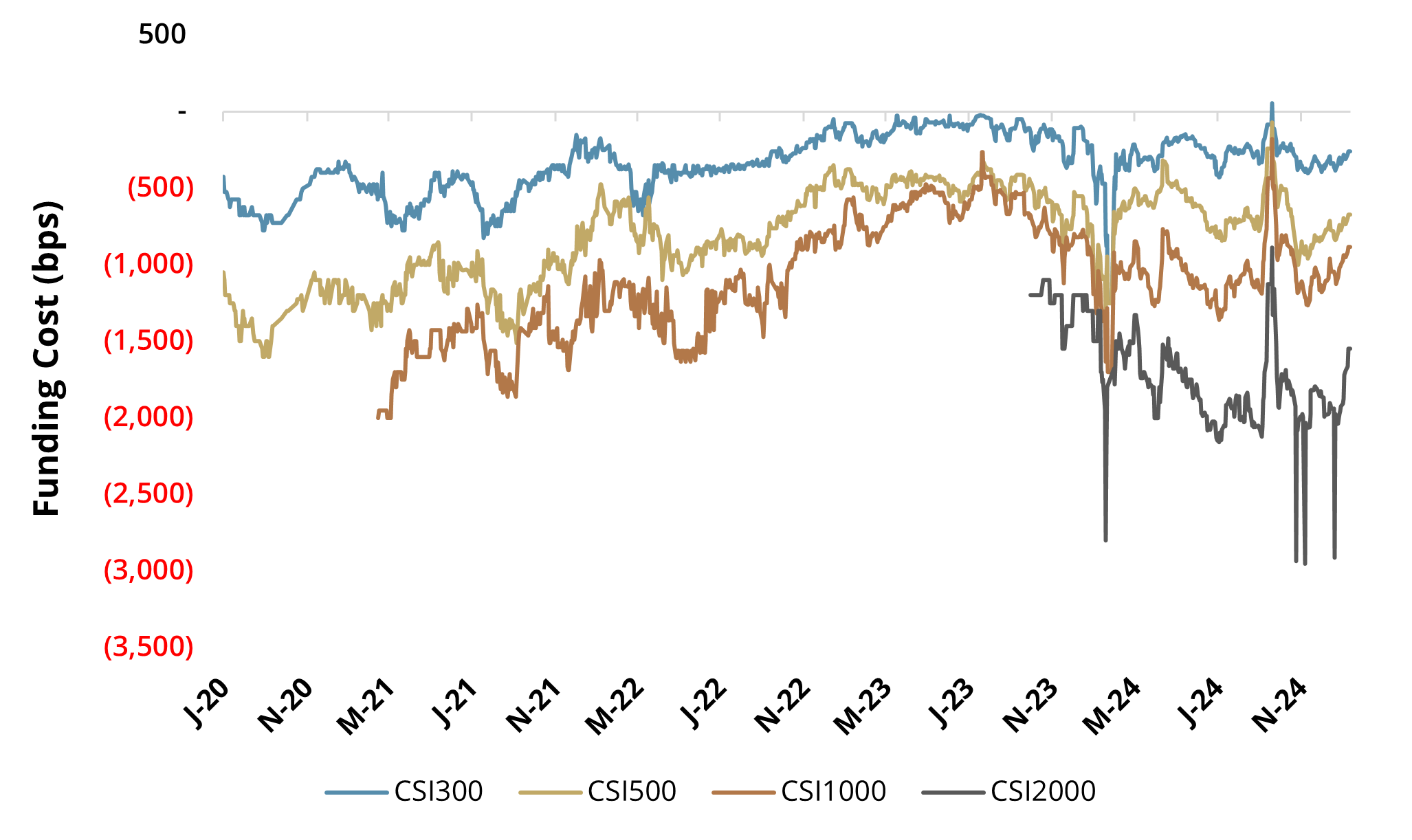

That funding cost advantage varies with the demand to short stocks. However, it can be quite significant and for the vast majority of time produces a significant tailwind for investors. As noted above, there are several CSI indices, each capturing a different slice of A share market capitalizations. TRS are thus available on each of these, and each has its own funding cost advantage.

Figure 4 below depicts the past several years of funding costs for the CSI indices. Over the common period going back to October of 2023, the simple average among the four has been around 9.50%. And just to reiterate, since the chart below depicts negative numbers on the y-axis, the funding “cost” is the income an investor earns by going long the exposure of the reference index and is in addition to whatever return the index and any currency movement provide.

Figure 4: CSI Funding Cost

6mo Swap Tenor

While the “getting exposure and getting paid to take” concept provides a significant benefit to investors looking to invest in China, CAS will dynamically optimize its exposure across the various market capitalizations (e.g. CSI 300, 500, 1,000, and 2,000) as a function of (a) the differentials in funding cost advantages and (b) the attractiveness of larger versus mid versus smaller market caps.

In Conclusion

CAS’s innovative approach yields several benefits for investors. First, it ameliorates the complexity associated with accessing the A share market, arguably the most attractive portion of Chinese equities. Second, it sidesteps the resource intensity and uncertainty associated with a stock picking approach. Third, CAS focuses on harvesting the structural return components which result from China’s unique market structure, delivering the most attractive elements of China in an efficient, liquid, and transparent ETF vehicle. It can play a powerful role for investors looking to invest in China, one which will likely provide a more consistent and more positive return stream compared to typical passive exposures.

1Numerous practical considerations have limited Stock Connect’s popularity. While these are beyond the scope of this paper, the triviality of the numbers is nonetheless surprising.

GLOSSARY:

American Depositary Receipt (ADR): Negotiable certificate issued by a U.S. depositary bank representing a specified number of shares—usually one share—of a foreign company's stock.

Global Depositary Receipt (GDR): A negotiable financial instrument issued by a depositary bank. It represents shares in a foreign company and trades on the local stock exchanges in investors' countries.

International Swaps and Derivatives Association (ISDA): The association works to establish and oversee policies and legal statutes surrounding the trading of derivatives.

Qualified Foreign Institutional Investor (QFII) Scheme: A transitional arrangement that allows international institutional investors who meet certain qualification to directly invest in a permitted range of financial products in mainland China's capital market, in the context of incomplete free flow of capital accounts.

RMB (Renminbi): The currency system in China.

RMB Qualified Foreign Institutional Investor (RQFII) Scheme: Allows qualified foreign investors in certain pilot countries or regions to directly invest in mainland China's capital market using offshore RMB.

Swap: An agreement between two parties to exchange sequences of cash flows for a set period of time. Usually, at the time the contract is initiated, at least one of these series of cash flows is determined by a random or uncertain variable, such as an interest rate, foreign exchange rate, equity price, or commodity price.

TRS (Total Return Swaps): A total return swap is a swap agreement in which one party makes payments based on a set rate, either fixed or variable, while the other party makes payments based on the return of an underlying asset, which includes both the income it generates and any capital gains.