Simplify Multi-QIS Alternative ETF (QIS)

A New Way to Diversify Stock/Bond Portfolios with QIS

Introduction

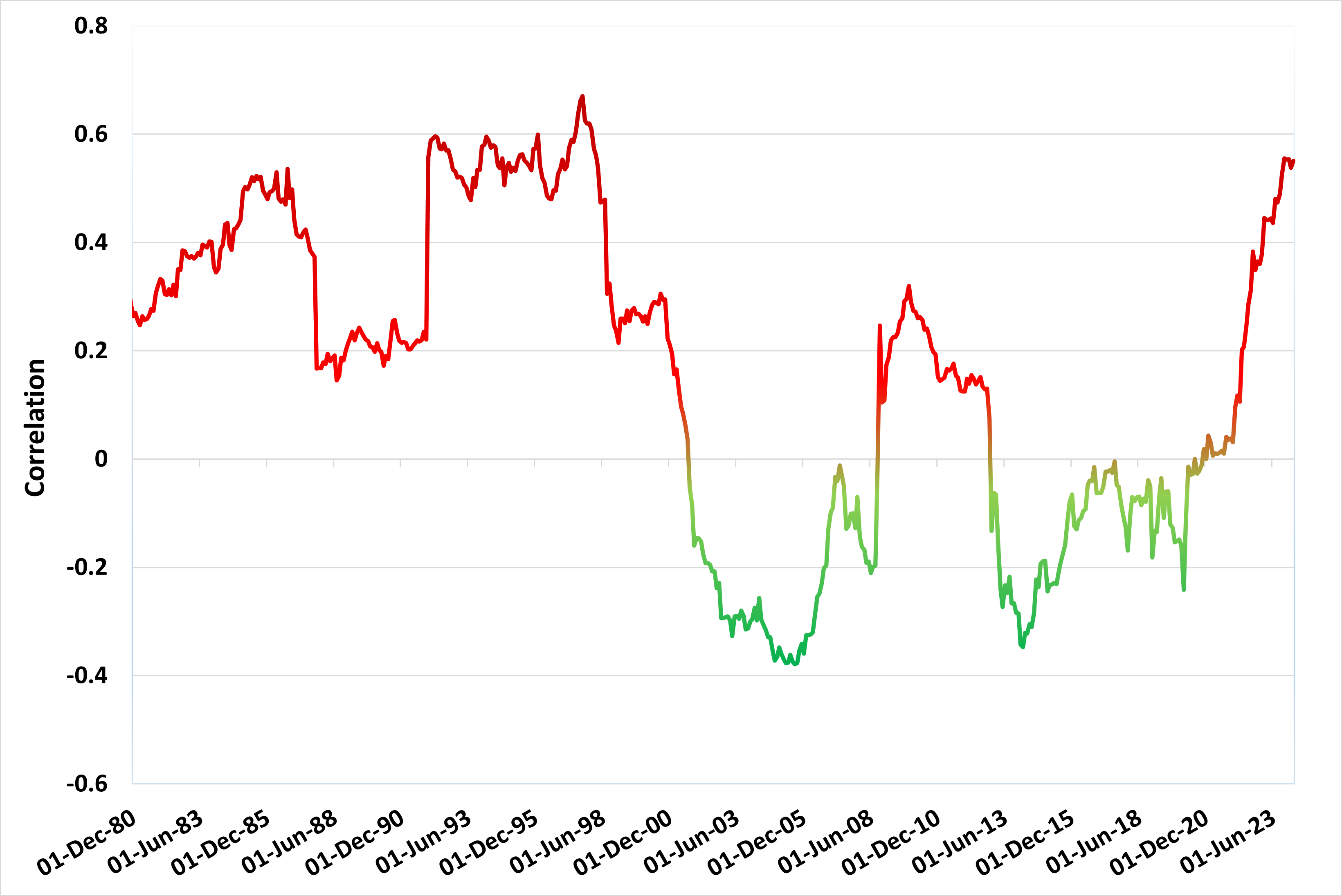

Since early 2022, investors have been reminded of the fact that stocks and bonds can be positively correlated during risk-off events. As Figure 1 shows, this should be viewed as the norm rather than the exception. For the better part of the last 50 years, stocks and bonds have been positively correlated, suggesting that the presumption of balance offered by a 60/40 portfolio of stocks and bonds should not be leaned on too heavily. This problem drives the Simplify team to develop and offer diversifying strategies that have negative correlations to stocks and bonds, especially during periods of de-risking, while also prioritizing absolute return profiles across different market environments. In this Fund Insights blog, we will discuss one such strategy: the Simplify Multi-QIS ETF (QIS). This fund is designed to create a unique absolute return profile by investing in a carefully orchestrated portfolio of third-party quantitative investment strategies across multiple asset classes and factors.

Correlation, Trailing 12 Mo. 3/31/80 – 3/31/24

What is QIS Investing?

Quantitative investment strategies rely on mathematical models, statistical techniques, and algorithmic trading to make investment decisions. These strategies are typically offered by banks or research firms to institutional investors and are typically delivered via swaps. There are thousands of quant strategies available to institutional investors, with individual strategies in all major asset classes and specific factors or attributes such as carry, volatility, technical momentum, fundamentals, and liquidity, to name a few. And according to alternative investment consultancy Albourne Partners, quantitative investment strategies have grown to $370 billion in assets under management as of mid-2022, driven largely by demand for uncorrelated diversification away from fixed income.

What is the Simplify Multi-QIS Alternative ETF?

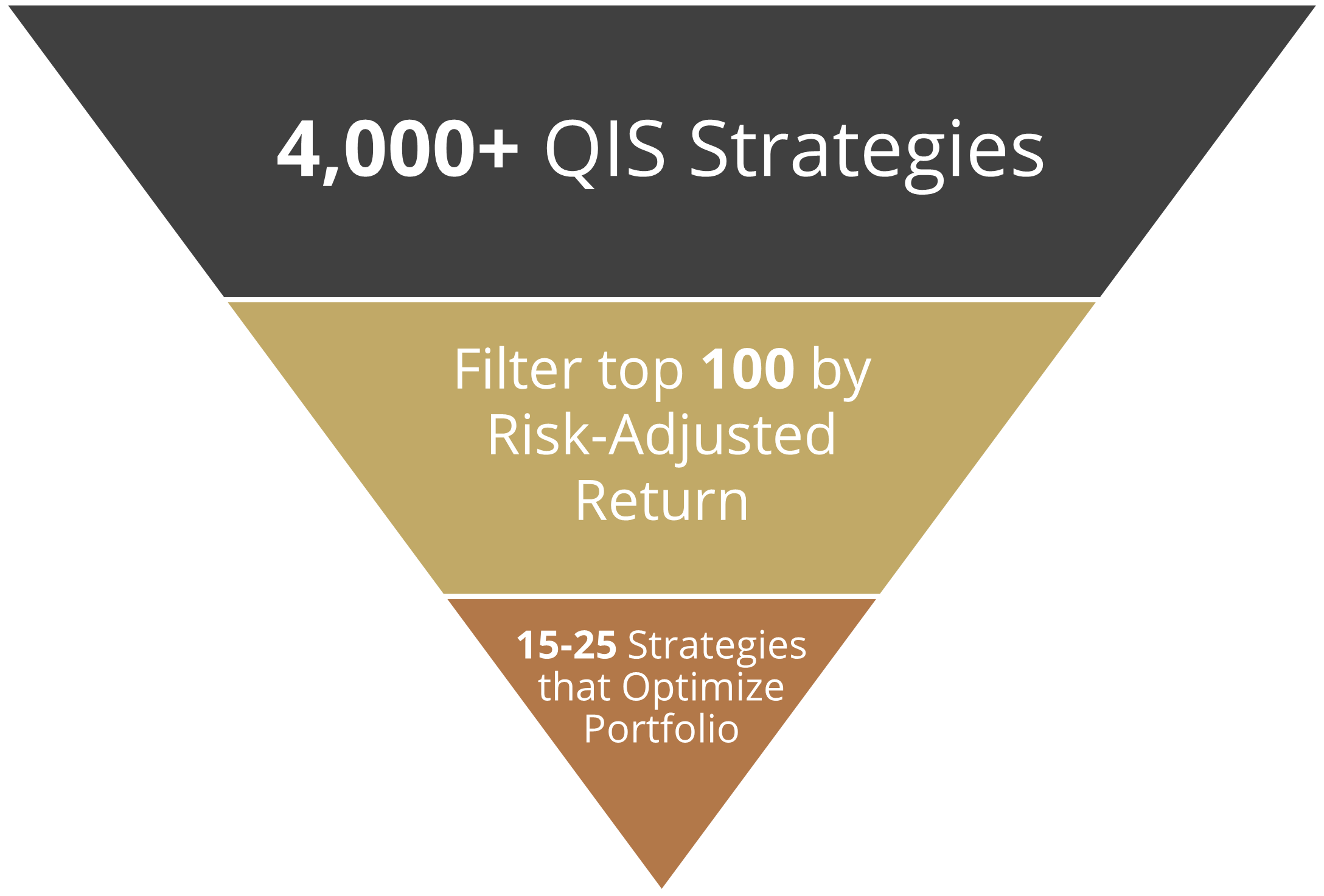

The Simplify Multi-QIS Alternative ETF (QIS) is designed to deliver positive absolute returns and income by thoughtfully combining very distinct quant strategies from across asset classes and strategy types. QIS invests in swaps of third-party strategists, and with thousands of available QIS, a rigorous approach and deep knowledge across the space are paramount. The portfolio construction process is outlined in Figure 2. First, we evaluate thousands of quantitative strategies managed by top investment banks and then narrow them down to a few hundred with the most compelling risk-adjusted return profiles. Ultimately, an optimized collection of 15-25 strategies is chosen, aimed at achieving positive returns while mitigating risks associated with individual asset classes and strategies.

Figure 2: Choosing QIS Strategies

The fund operates primarily through total return swaps, which provide returns based on the performance of model portfolios generated by the selected quantitative strategies. This approach allows QIS to harness the performance of the strategy in a capital efficient manner within the ETF wrapper, avoiding lockups, accreditation requirements, K-1s, and incentive fees. The diversified nature of the portfolio helps in spreading risk across various strategies and asset classes, making it less susceptible to market volatility and individual strategy failures. To drive this point home, QIS targets 8-10% annualized volatility and a long-term Sharpe ratio in excess of 1.

Why It Can Complement Bonds in a Traditional 60/40 Portfolio

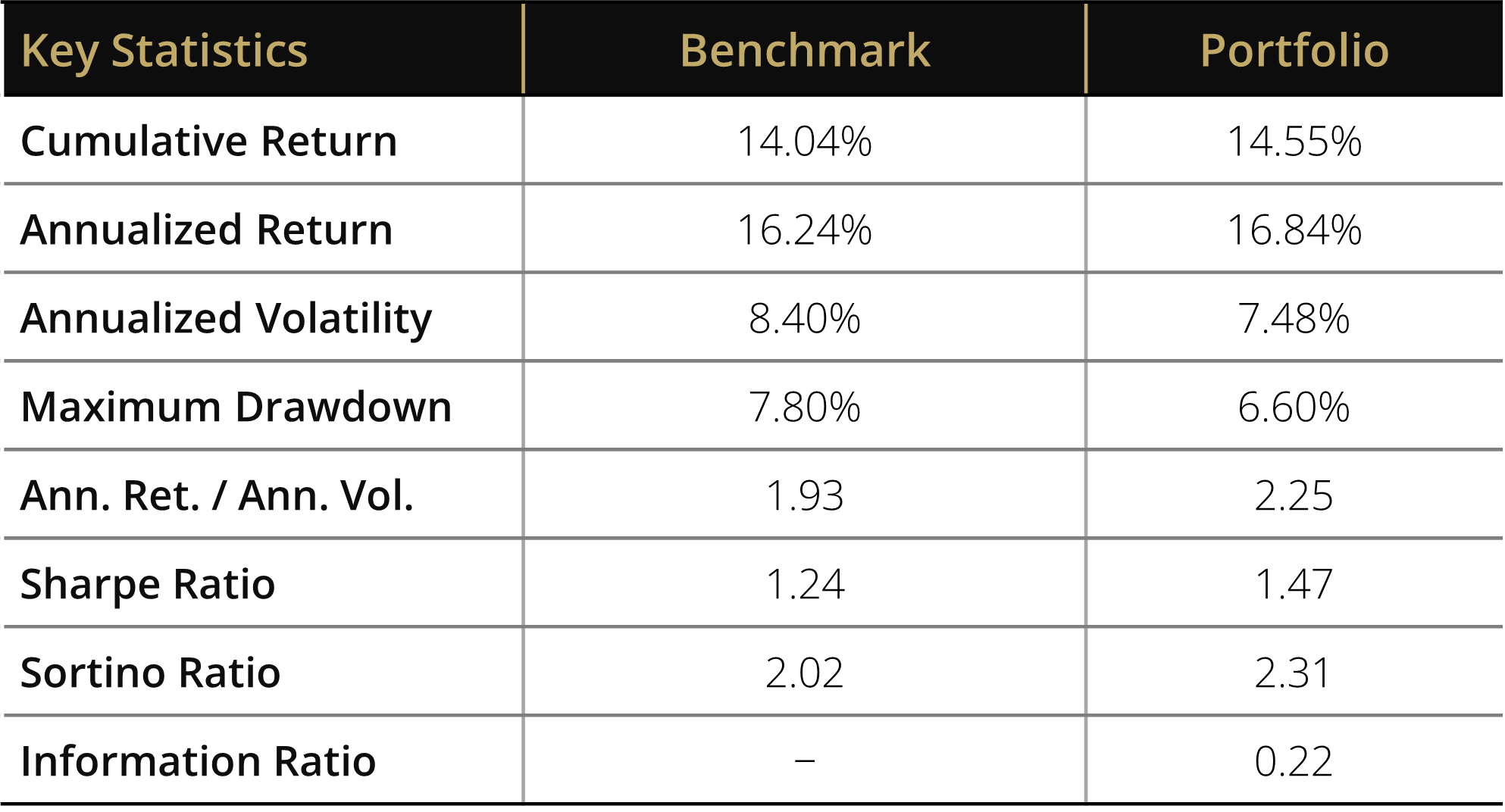

A traditional 60/40 portfolio, which allocates 60% to equities and 40% to bonds, has been a staple for many investors seeking a balanced approach to growth and income. However, the current environment of positive correlations between stocks and bonds, driven by high inflation and fixed income volatility, poses challenges for fixed income to deliver attractive returns. The QIS ETF offers a compelling alternative to bonds by providing exposure to a range of quantitative strategies designed to generate positive returns regardless of market conditions.Since its inception on July 10th, 2023, QIS has outperformed the Bloomberg Aggregate Bond Index by over 250 basis points (bps). QIS displayed lower volatility and max drawdowns during this period, as well, with the strategy experiencing a 1.21% max drawdown versus the bond index’s 6.09% max drawdown. Further, QIS displayed a negative correlation to both stocks and bonds, demonstrating its ability to deliver absolute returns independent of traditional risk assets. In fact, a portfolio that included 60% S&P 500 Index, 20% Bloomberg US Aggregate Bond Index, and 20% QIS outperformed a 60/40 portfolio of stocks and bonds while reducing volatility and drawdowns (see Figure 3). The portfolio’s Sharpe and Sortino ratios also improved meaningfully.

60/20/20 Stock/Bond/QIS Portfolio

7/11/2023 - 5/16/2024

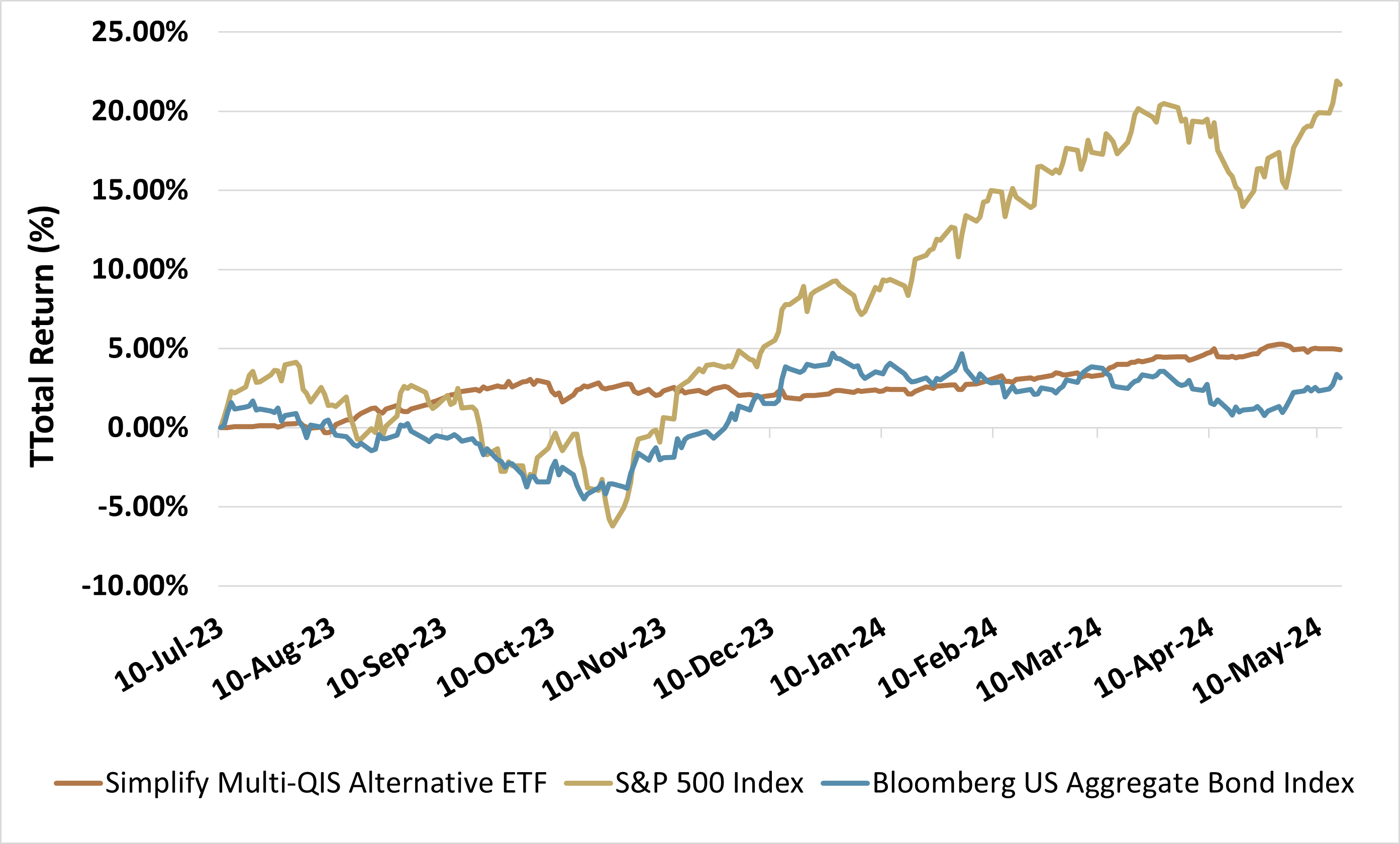

Year-to-Date Performance

This year has been an excellent proving ground for QIS. As of May 14th, 2024, QIS has delivered a year-to-date total return of 2.55%. And outside a brief period in January, the fund’s performance has been without a max drawdown greater than 0.50%. On the other hand, the Bloomberg US Aggregate Bond Index experienced a drawdown of more than 3% during that same period - with a significant portion of the drawdown occurring in early April when stocks were also selling off. The QIS ETF’s ability to achieve positive returns amidst market fluctuations highlights its potential as a valuable tool for investors seeking to enhance their portfolio’s performance.Figure 4: Stocks, Bonds, QIS, Total Return

7/10/2023 - 5/16/2024

The performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment returns and the principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. For performance data current to the most recent month-end please call (855) 772-8488 or go to https://www.simplify.us/etfs. For standardized performance, click here.

Conclusion

The Simplify QIS ETF represents a significant evolution in the realm of alternative ETFs, offering a sophisticated solution for modern portfolio management. Its ability to provide positive absolute returns through a diversified portfolio of quantitative strategies makes it an attractive option for investors looking for a complement to bonds in their traditional 60/40 portfolios. As markets continue to evolve, innovative products like QIS are likely to play an increasingly crucial role in helping investors achieve their financial goals.

Glossary:

Basis Points: A common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%.

Schedule K-1: A federal tax document used to report the income, losses, and dividends of a business' or financial entity's partners or an S corporation's shareholders.

Sharpe Ratio: The ratio compares the return of an investment with its risk. It's a mathematical expression of the insight that excess returns over a period of time may signify more volatility and risk, rather than investing skill.

Sortino Ratio: A variation of the Sharpe ratio that differentiates harmful volatility from total overall volatility by using the asset's standard deviation of negative portfolio returns—downside deviation—instead of the total standard deviation of portfolio returns.

Swap: An agreement between two parties to exchange sequences of cash flows for a set period of time. Usually, at the time the contract is initiated, at least one of these series of cash flows is determined by a random or uncertain variable, such as an interest rate, foreign exchange rate, equity price, or commodity price.