Introduction

Simplify is revolutionizing the income-focused structured product landscape by offering innovative structured note exposures via ETFs. The Simplify Barrier Income ETF (SBAR) and the Simplify Target 15 Distribution ETF (XV) offer a more flexible and streamlined alternative to traditional structured products by eliminating bank credit risk, reducing compliance burdens, ensuring continuous liquidity, and seamlessly rolling into new vintages. Simplify’s investment approach in these funds offers investors a powerful way to access the most compelling form of option-based income.

Background on Structured Notes

Investors buy structured notes for their ability to offer customized exposure to market returns while incorporating features that align with specific investment objectives. These products can generate income, provide contingent downside exposure based on a barrier, enhance participation in market gains, or combine multiple benefits, making them attractive for those seeking tailored risk-reward profiles. Additionally, structured notes can help mitigate volatility, offer principal protection, and optimize returns through innovative payout structures such as barriers, callability, or leveraged upside participation.

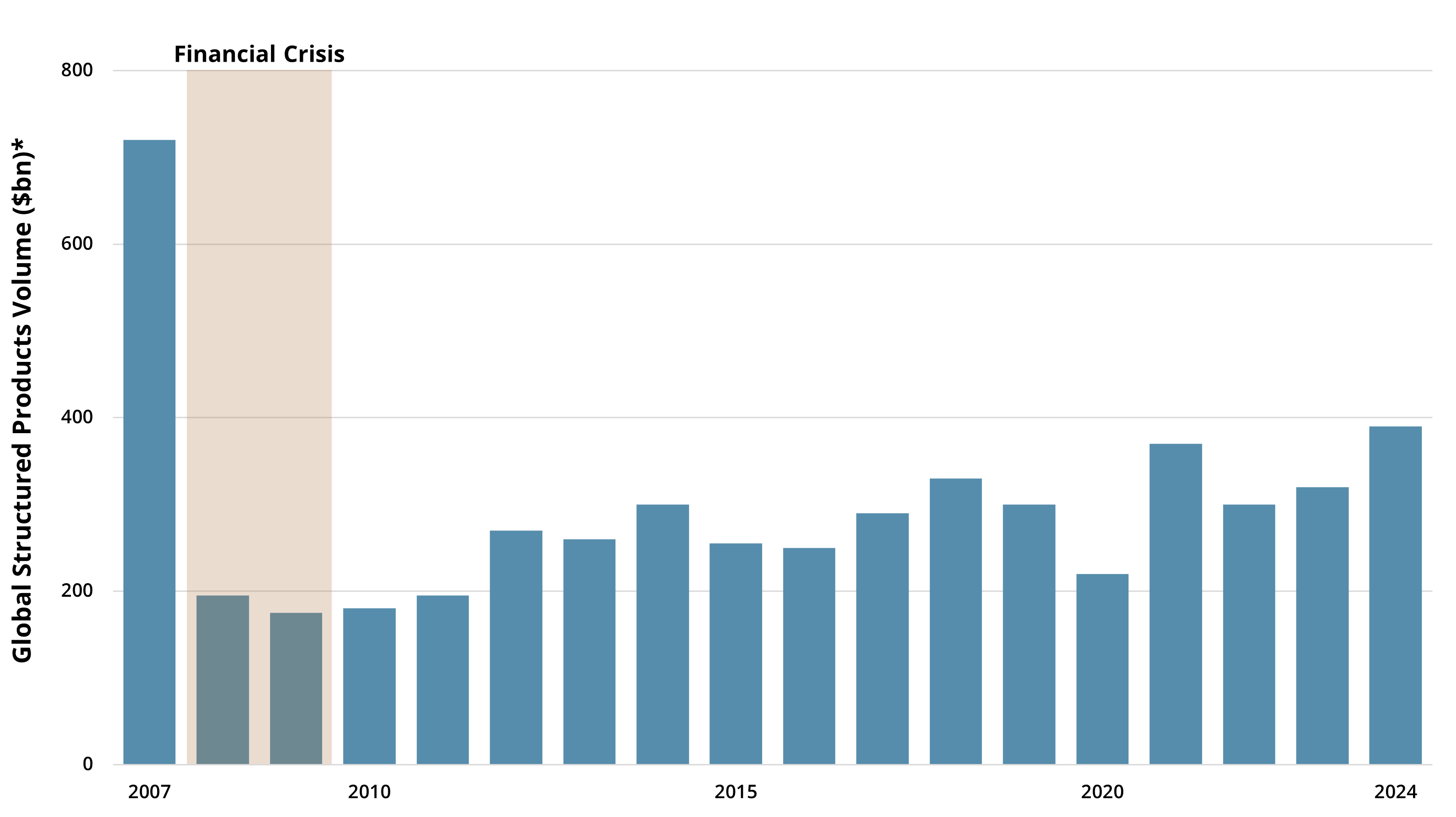

Figure 1 below illustrates the annual global demand for structured products. Following the global financial crisis, regulatory measures such as the Dodd-Frank Act dampened investor appetite for these instruments. However, since 2009, transaction volumes have rebounded, with the structured finance market — including structured notes — experiencing significant growth. In 2023, total structured finance transactions reached $380 billion, exceeding the previous post-crisis peak set in 2021. This expansion reflects the growing demand for customized investment solutions that offer flexibility, risk management, and potential upside across diverse asset classes.

Figure 1: Global Structured Product Volume

Structured notes have historically been perceived as complex investment vehicles that present both operational challenges and investment inefficiencies. They often lack liquidity, carry high fees, and expose investors to issuer credit risk, while their performance can be uncertain due to capped returns and intricate payout structures. Additionally, their limited transparency and the potential for early redemption by issuers further complicate risk assessment, making them more suitable for sophisticated investors with the expertise to navigate these complexities.

An Alternative to Structured Notes

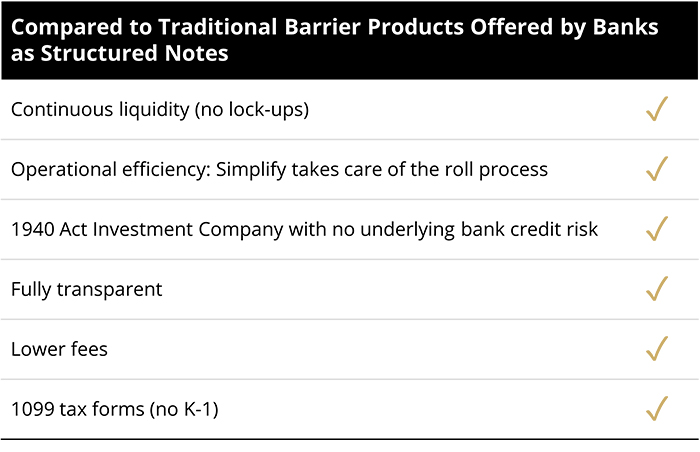

Simplify Barrier ETFs now provide a more operationally efficient alternative to traditional structured notes by eliminating key constraints that often burden investors. With continuous liquidity and no lock-up periods, investors can enter and exit positions with ease, unlike traditional notes that may have rigid holding requirements. Professional rolling ensures seamless portfolio management, removing the complexity of manually reinvesting in new structures. Additionally, Simplify Barrier ETFs eliminate bank credit risk, offering exposure without reliance on issuer solvency. The fully transparent structure, lower fees, and avoidance of K-1 tax forms further enhance investor convenience, making these ETFs a cost-effective and streamlined solution for accessing structured product benefits. Figure 2 highlights the operational burden removed by Simplify’s structured product offerings:

Figure 2: Operational Efficiencies Gained by Simplify’s Approach

Simplify’s Approach to Income-Focused Structured Products

Simplify’s newest structured product offerings are designed to provide investors with a high level of monthly income through the sale of barrier put options, seeking an attractive yield while maintaining risk mitigation. A key differentiator of SBAR and XV is their enhanced income potential, driven by a contingent downside feature that selects the "worst-of" three reference assets representing U.S. large cap stocks, U.S. small cap stocks, and U.S. growth stocks. The reference assets can be indices and/or ETFs that represent the indices. The "worst-of" feature is based on price return at maturity, combined with callability provisions. Additionally, both structures reduce path dependency risk through a laddered approach to swap contracts, providing a more predictable and balanced risk-return profile.

“Worst-Of” Feature

To enhance monthly income, SBAR and XV employ a barrier put option with a "worst-of" feature. Selling a "worst-of" deep out of the money (OTM) barrier put option on a diversified basket of reference assets allows for the collection of higher premiums while maintaining a disciplined risk framework. This approach capitalizes on the low probability of the option being exercised, as it remains significantly OTM. By structuring these options with a typical 12-month duration, the strategy seeks to maximize premium retention while providing contingent downside exposure, and we believe this will ultimately deliver an attractive income stream for investors.

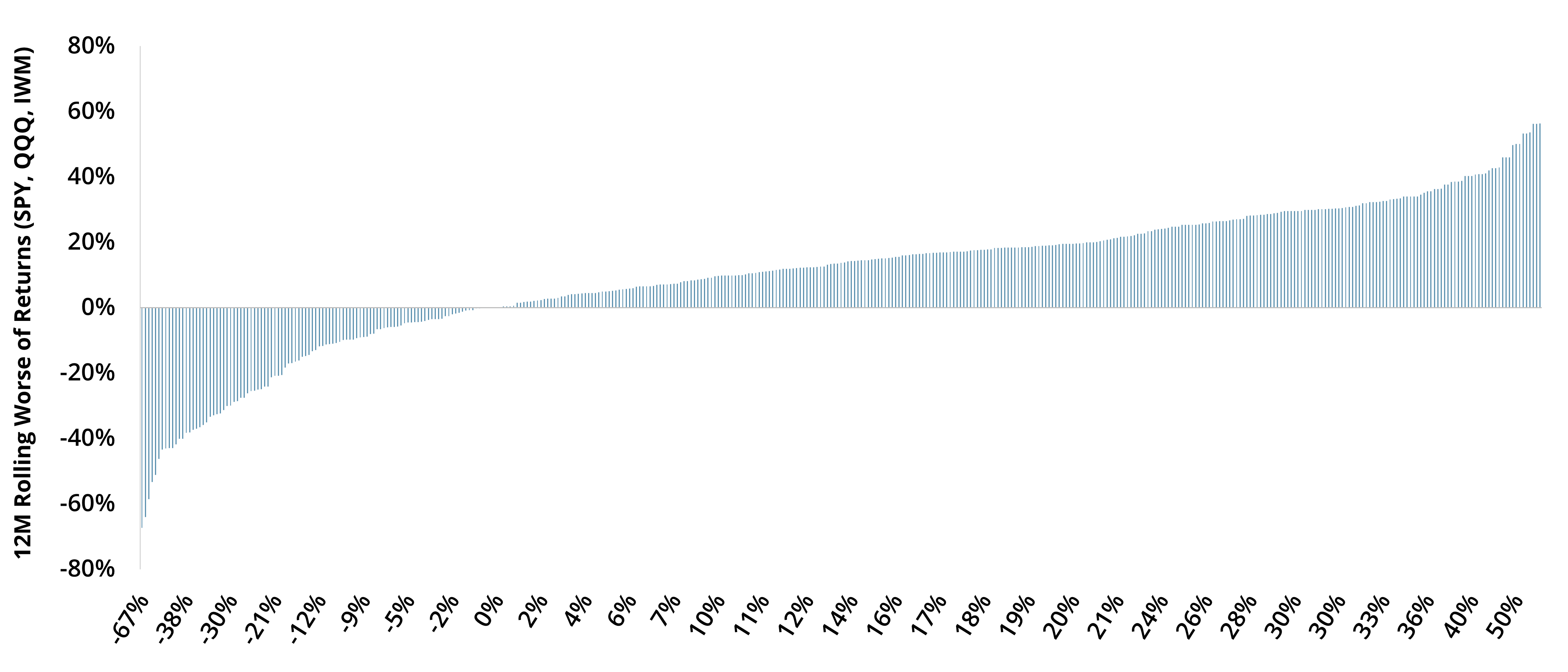

SBAR incorporates a 30% barrier put option, designed to provide contingent downside exposure while enhancing income potential. Empirical analysis of rolling 12-month periods suggests that the barrier level has been breached approximately 6% of the time, leading to drawdowns. Notably, these breaches were predominantly observed during periods of extreme market stress, such as the Technology Bubble and the 2008–2009 Global Financial Crisis, highlighting the impact of systemic risk and heightened volatility during those episodes. Figure 3 below illustrates rolling 12-month returns since June 2000 of three ETFs representing the reference assets, offering valuable insight into the historical performance of this risk framework.

Figure 3: 12 Month Rolling Returns – SPY, QQQ, IWN

Figure 4 below sorts the “worst-of” SPY, QQQ, IWN rolling 12-month returns since 2000. You can see from the statistics that the frequency of breaking a 30% barrier is rare.

Figure 4: Rolling 12-Month “Worst-Of” Returns (SPY, QQQ, IWN)

Callability Feature

A non-callable interest rate swap eliminates the option for early termination, ensuring that fixed-rate payments persist throughout the full contract term. This structural rigidity leads to higher fixed-rate payments, as the floating-rate receiver requires additional compensation for the inability to unwind the agreement in favorable market conditions. Consequently, non-callable swaps provide higher income to the floating-rate payer, making them particularly appealing to investors seeking enhanced yield and greater predictability. SBAR and XV will incorporate varying non-callable periods (e.g., one month, two months) to optimize income generation while maintaining a defined investment horizon.

SBAR vs. XV

Both SBAR and XV employ an activation barrier, which denotes the specific price level that must be breached for a knock-in option to become operative. In the case of a knock-in put option, the option is only triggered if the underlying asset’s price declines to or below the designated barrier level. Until this threshold is reached, the option remains dormant and cannot be exercised.

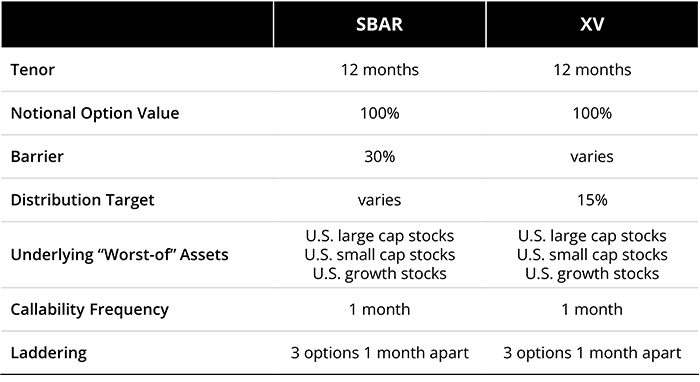

SBAR is designed to maintain a defined risk threshold, with a barrier level set at 30% to provide contingent downside. In contrast, XV aims to achieve a 15% income target by strategically adjusting key parameters such as term structure, barrier level, and callability. This dynamic, actively managed approach inherently results in a higher income-to-risk profile, offering investors an optimized balance between yield enhancement and risk exposure. Figure 5 highlights the main differences between the baseline trades in SBAR and XV, though precise parameters can vary in the active strategies.

Figure 5: Contrasting the Core Trades in SBAR and XV

Outcome and Scenario Analysis

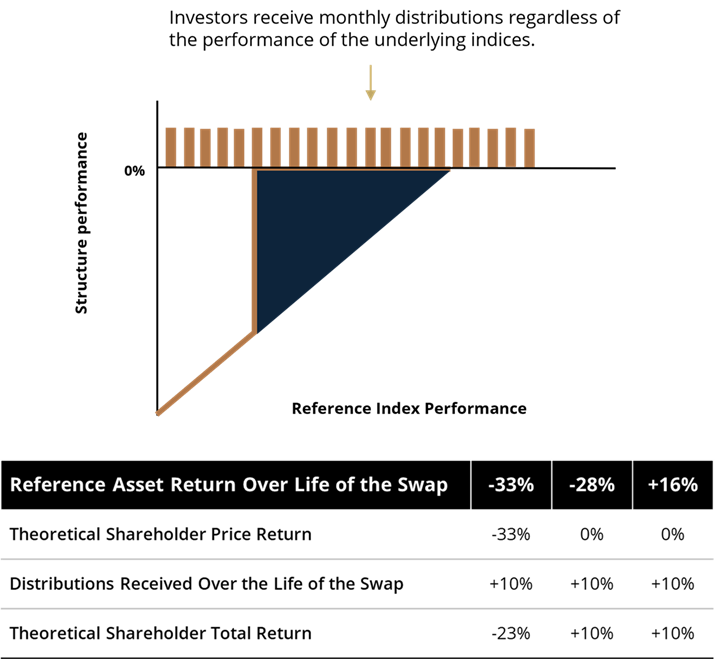

When combined, the above elements create a robust barrier to losses while generating high monthly income. As illustrated in Figure 6, SBAR incorporates both income generation and contingent downside mechanisms. The protective barrier remains intact as long as the "worst-of" the three reference assets does not experience a price decline exceeding -30% by the end of the swap term. Additionally, SBAR employs a laddered swap structure, mitigating path dependency and enhancing risk management.

Figure 6: Outcome Visual and Scenarios Analysis

Conclusion – A Smart Approach to Structured Income

Simplify is revolutionizing structured investing by seeking higher income, contingent risk, and greater operational efficiency—all within a transparent and flexible ETF framework. By eliminating bank credit risk, reducing compliance burdens, and ensuring continuous liquidity, we believe our ETFs provide a superior alternative to traditional structured notes.

With features such as barriers, “Worst-of” options, and laddered swaps, our actively managed strategies optimize risk-adjusted return potential while seeking to provide a consistent and attractive yield. Whether targeting contingent downside with SBAR or maximizing income potential with XV, Simplify offers cutting-edge solutions for investors seeking structured product benefits without their limitations.

GLOSSARY

Duration: A measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates.

Interest Rate Swap: Is a forward contract in which one stream of future interest payments is exchanged for another based on a specified principal amount. Interest rate swaps usually involve the exchange of a fixed interest rate payment for a floating rate payment, or vice versa, to reduce or increase exposure to fluctuations in interest rates, or to obtain a marginally lower interest rate than would have been possible without the swap. A swap can also involve the exchange of one type of floating rate for another, which is called a basis swap.

Knock-in Option: A type of barrier option where the rights associated with that option only come into existence when the price of the underlying security reaches a specified barrier during the option's life. Once a barrier is knocked in, or comes into existence, the option remains in existence until it expires.

Option: An option is a contract that gives the buyer the right to either buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a pre-determined price ("strike") by a specific date ("expiry"). An "outright" is another name for a single option leg. A "spread" is when options are bought at one strike and an equal amount of options are sold at a different strike, all at the same expiry.

Out of the Money: An option has no intrinsic value, only extrinsic or time value.

Structured Note: A debt obligation that also contains an embedded derivative component that adjusts the security's risk-return profile.

Swap: An agreement between two parties to exchange sequences of cash flows for a set period of time. Usually, at the time the contract is initiated, at least one of these series of cash flows is determined by a random or uncertain variable, such as an interest rate, foreign exchange rate, equity price, or commodity price.

Volatility: A measure of how much and how quickly prices move over a given span of time.