Volatility Strikes Back

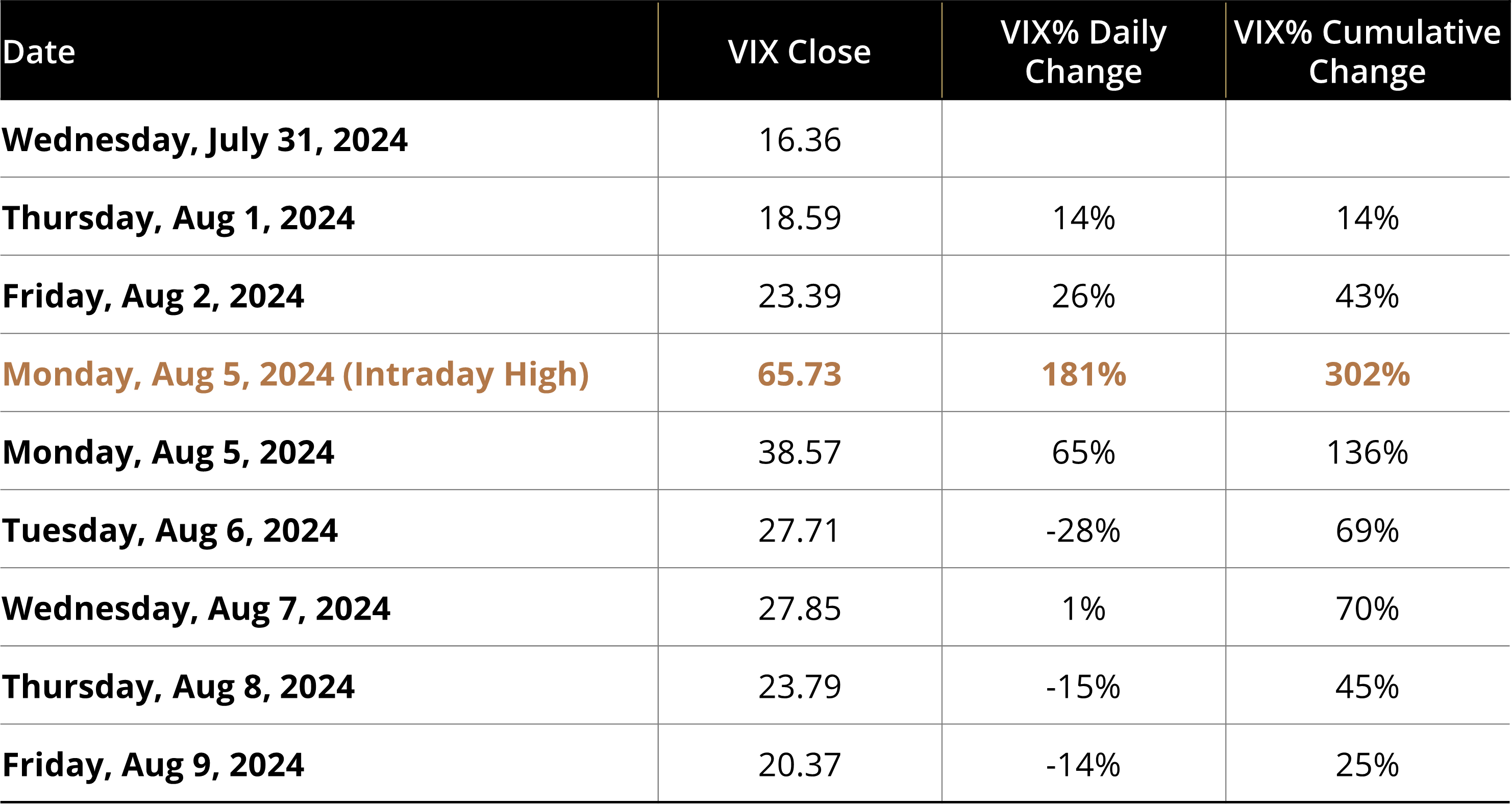

Two weeks ago, volatility struck back after an exceptionally long period of market calm, during which the S&P 500 Index went 356 sessions without a drop of 2% or more—the longest such streak since 2007. Table 1 provides specific details of this historic VIX move from July 31, 2024, to August 9, 2024. This spike in volatility was fueled by a combination of factors, including earnings reports, job data, ongoing recession fears, and a sell-off in the Japanese market driven by the unwinding of the Yen carry trade.

Table 1: Recent VIX Spike

Investment strategies that short the VIX index had challenges with this surge in the VIX. Simplify’s fund in this space, the Simplify Volatility Premium ETF (SVOL), navigated this episode nicely. Let us dig in on SVOL’s response to this event.

How is SVOL Different from Other Short VIX Products?

Investors pay a premium for downside hedges, driving up the demand for hedging via VIX futures contracts. This results in an upward-sloping futures curve known as Contango—a condition present approximately 85% of the time. SVOL capitalizes on this by shorting VIX futures at various points along the curve, not just at the front of the curve, because each point on this curve has a distinct roll yield and volatility profile. This flexibility is paramount to SVOL’s success versus products just shorting the front of the curve.

Additionally, SVOL typically shorts between 20% and 30% of its portfolio across the VIX futures term structure, greatly limiting downside risk compared to other products with more exposure. Finally, SVOL allocates 2% to 4% of its portfolio annually to mitigate VIX spikes, utilizing strategies such as purchasing call options on the VIX or implementing equity puts or put spreads for added downside hedges.

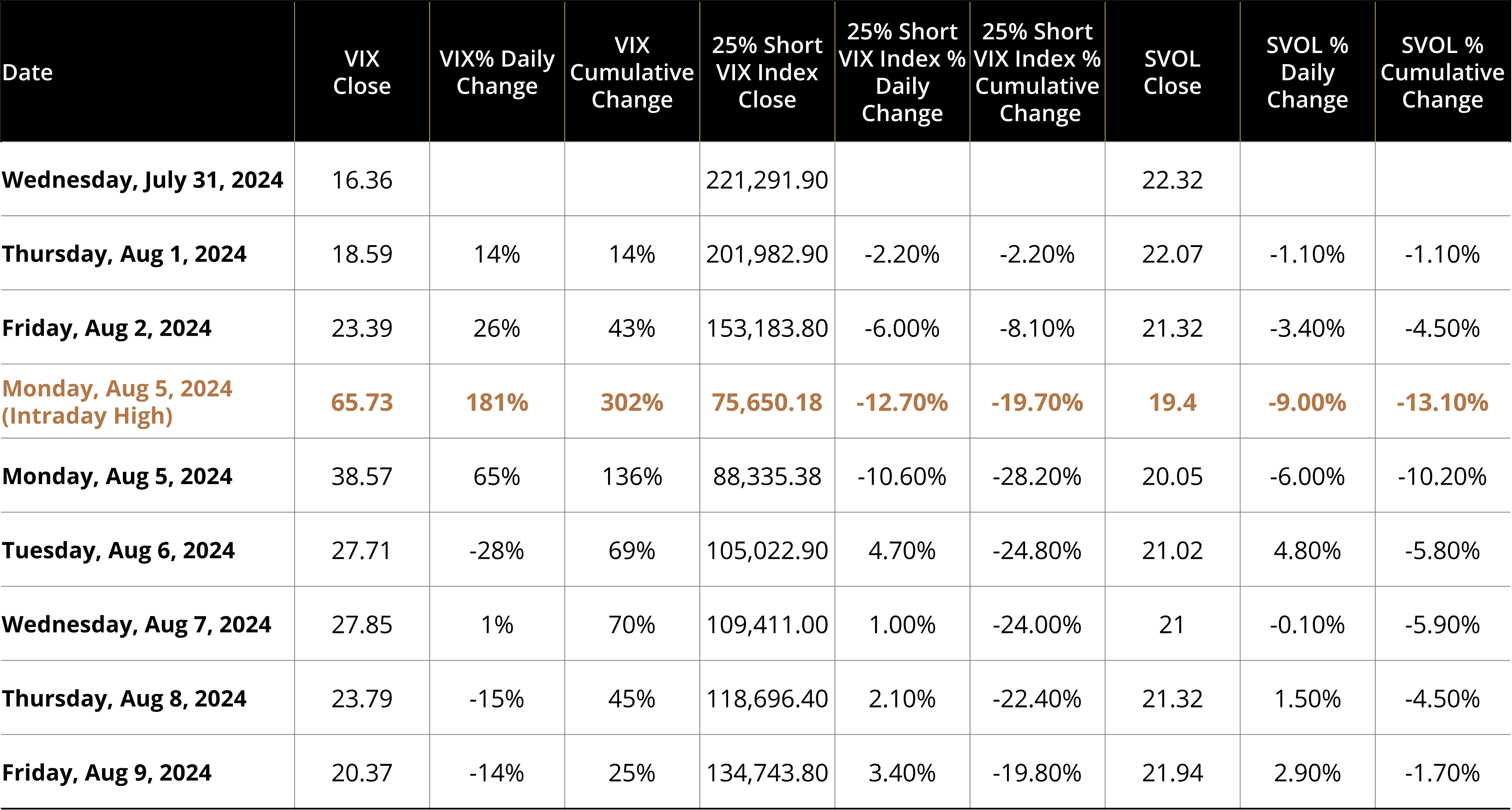

Table 2 provides VIX closing prices, percentage change, and cumulative percentage change from July 31, 2024 for VIX, 25% Short VIX Index, and SVOL.

Table 2: VIX vs. 25% Short VIX Index vs. SVOL

the S&P 500 VIX Short Term Futures Inverse Daily Index x 25%.

Key observations from Table 2 are:

- Between July 31, 2024, and August 9, 2024, the VIX rose by 25%, the 25% Short VIX Index declined by 19.8%, and SVOL was down 1.7%

- From July 31, 2024, to August 5, 2024, the VIX surged 65%, the S&P 500 VIX Future Inverse Index # dropped 28.21%, and SVOL fell by 10.2%

- Despite the VIX reaching its highest intra-day level (up 308% from July 31, 2024), SVOL's drawdown was limited to 13%, demonstrating the effectiveness of its risk management techniques

The first week of August put the Simplify Volatility Premium ETF’s risk management techniques to the test. Unlike a simple short VIX futures strategy, SVOL employs a more sophisticated approach. By limiting its short futures exposure to 20-30%, strategically positioning along the VIX futures curve, and utilizing VIX call options and put spreads on the S&P 500, SVOL aims to deliver more favorable total returns than merely tracking the inverse VIX index. We believe that SVOL is a better-designed short VIX strategy, offering investors an alternative source of equity income with enhanced risk management.

GLOSSARY:

Option: An option is a contract that gives the buyer the right to either buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a pre-determined price ("strike") by a specific date ("expiry"). An "outright" is another name for a single option leg. A "spread" is when options are bought at one strike and an equal amount of options are sold at a different strike, all at the same expiry.

VIX Index: A real-time market index representing the market's expectations for volatility over the coming 30 days.