Introduction

The Simplify Volatility Premium ETF (SVOL) exemplifies an innovative approach to volatility harvesting, aiming to generate sustainable income while maintaining Net Asset Value (NAV) stability. In response to heightened market risks and a doubling of beta in its short VIX strategy relative to U.S. Large Cap equities, the fund has implemented a strategic adjustment in January 2025. These adjustments included increasing the S&P 500 ETF (SPY) exposure, selling lower-beta VIX futures, and hedging against tail risk to optimize returns and reduce volatility sensitivity. In this write-up, we will review the strategy updates and the logic behind them.

Regime Shift in VIX Market

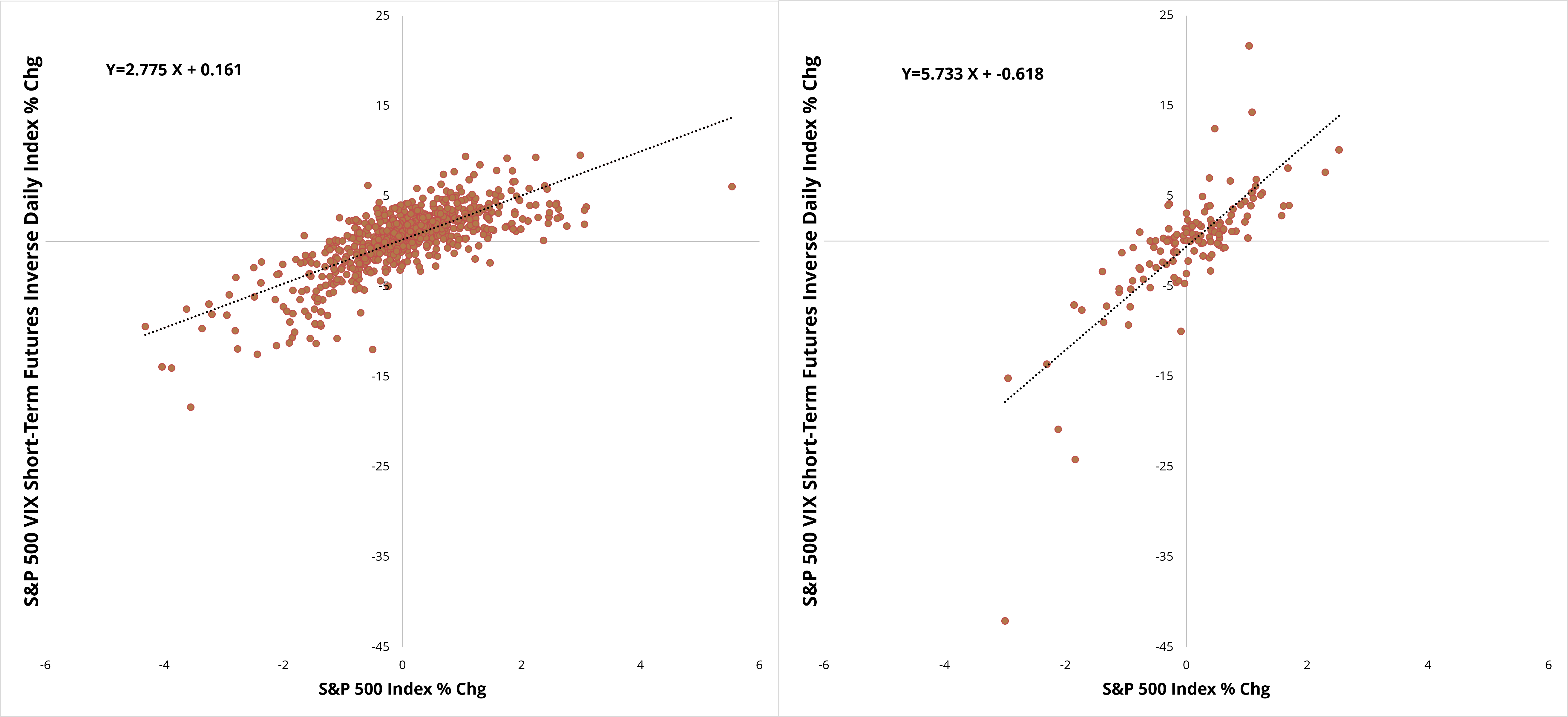

In January 2025, a key strategic enhancement was implemented in SVOL to recalibrate the fund's positioning in response to significant shifts in market volatility dynamics. Figure 1 below illustrates a notable trend over the past six months, wherein short VIX positions—a cornerstone strategy within SVOL—have experienced a sharp increase in beta relative to U.S. Large Cap equities. From SVOL's inception on May 11, 2021, through June 30, 2024, the beta of the S&P 500 VIX Short-Term Futures Inverse Daily Index relative to the S&P 500 Index averaged 2.774. However, in the six months ending December 31, 2024, this beta more than doubled to 5.728. This pronounced shift in beta prompted the portfolio management team to carefully evaluate alternative positioning strategies to sustain the income and returns that Simplify’s clients have come to expect.

Figure 1: Short VIX Futures Beta vs. S&P 500 Index

(05/11/21 to 06/30/24 & 07/01/24 to 01/09/25)

Strategy Update in Response

To mitigate this increased risk, SVOL implemented a range of proactive measures to enhance diversification and stability. These include selling lower-beta VIX futures further out on the curve, hedging against tail risk, and maintaining equity beta for NAV participation. These adjustments reflect the fund's commitment to adaptability in navigating market volatility and delivering sustainable distributions. By addressing the elevated beta of short VIX positions, Simplify ensures that SVOL remains aligned with its core objectives of generating a distribution rate targeting Fed funds plus 10% while maintaining NAV stability. These strategic enhancements underscore the fund's focus on optimizing returns relative to risk, even in challenging market conditions.

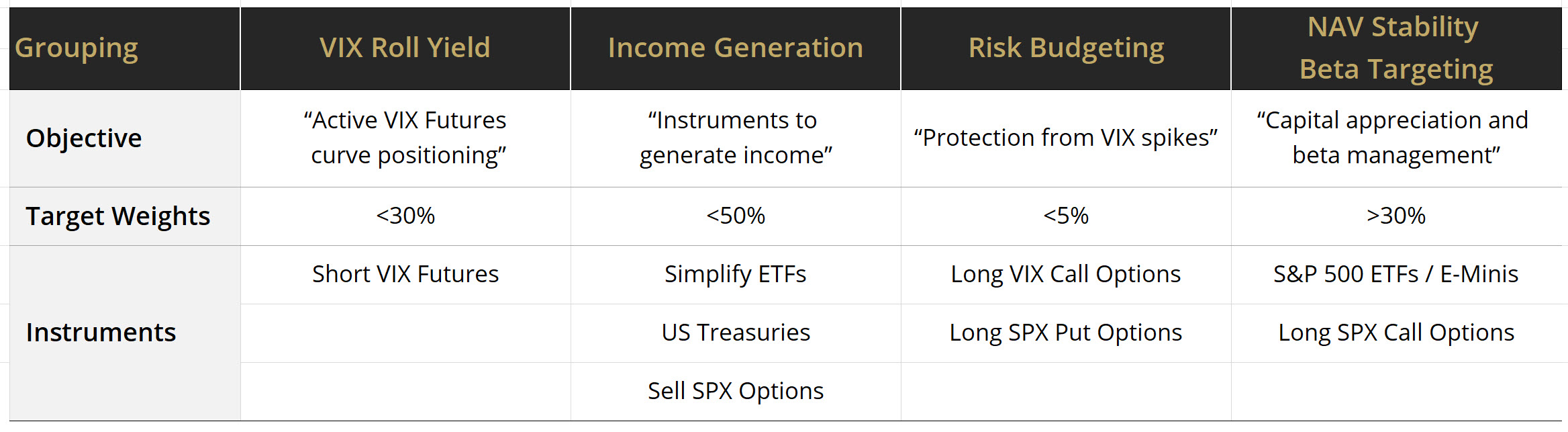

Figure 2 below provides a detailed visualization of SVOL exposure, categorized by group and aligned with their respective intended purposes. SVOL is structured into four primary groups: VIX Roll Yield, Income Generation, Risk Budgeting, and NAV Stability/Beta Targeting. For each group, the chart outlines the objectives, target weight allocations, and the specific instruments utilized to achieve the intended exposure.

Figure 2: Simplify’s Classification Matrix of SVOL Positions

The SVOL portfolio management team employs a dynamic and disciplined approach to navigating evolving market conditions, consistently working to achieve targeted outcomes. The team closely monitors key indicators such as implied volatility levels (e.g., the VIX), the steepness of the VIX futures curve, and the beta of VIX to equities (a la Figure 1) to identify opportunities for optimizing the VIX roll yield.

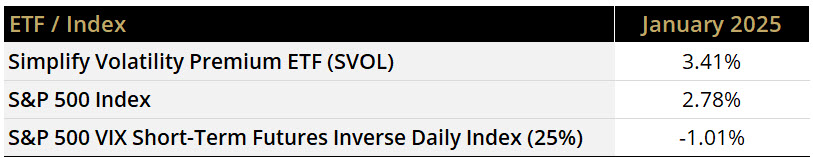

Early indicators highlight the success of the SVOL enhancement. As shown in Figure 4, SVOL capitalized on January’s strong market rally, outperforming both the S&P 500 VIX Short-Term Futures Inverse Daily Index and the S&P 500 Index.

Figure 3: January 2025 Total Returns

S&P 500 VIX Short-Term Futures Inverse Daily Index is 25% of the index return.

In Conclusion

Simplify’s SVOL fund exemplifies an innovative approach to volatility harvesting, aiming to generate sustainable income while maintaining NAV stability. In response to heightened market risks and a doubling of beta in its short VIX strategy relative to U.S. Large Cap equities, the fund implemented a strategic adjustment in January 2025. These adjustments included increasing SPY exposure, selling lower-beta VIX futures, and hedging against tail risk to optimize returns and reduce volatility sensitivity. By realigning its portfolio, SVOL has upheld its commitment to delivering a distribution rate targeting Fed funds plus 10% while preserving a balanced risk profile. The enhancements demonstrate the fund's adaptability and dedication to optimizing performance in evolving market conditions. The portfolio management team remains confident in the strategy.

GLOSSARY:

Beta: Measure of the volatility, or systematic risk, of a security or portfolio compared to the market as a whole (usually the S&P 500).

Futures: Derivative financial contracts that obligate parties to buy or sell an asset at a predetermined future date and price. The buyer must purchase or the seller must sell the underlying asset at the set price, regardless of the current market price at the expiration date.

NAV: The dollar value of a single share, based on the value of the underlying assets of the fund minus its liabilities, divided by the number of shares outstanding. Calculated at the end of each business day. Market Price: The current price at which shares are bought and sold. Market returns are based upon the last trade price.

Roll Yield: The return from adjusting a futures position from one futures contract to a longer-dated contract.

VIX Index: A real-time market index representing the market's expectations for volatility over the coming 30 days.

Volatility: A measure of how much and how quickly prices move over a given span of time.