Introduction

Latin American (LATAM) bonds present a potential opportunity for investors to pick up meaningful yield relative to comparable forms of credit in the U.S. The region offers a diversity of exposures across issuer types, ratings, and currencies. And the fundamentals supporting creditworthiness have generally been on an improving trajectory. We thus believe investors can capture this excess yield without having to sacrifice on credit quality. However, given the confluence of sovereign, political, sector, and idiosyncratic risks at play in the region, we also think the best approach is one anchored by a disciplined, fundamentals-grounded process.

Going “Unglobal”

Investors have historically taken exposure to Emerging Market Debt (EMD) on a global basis. And by “Global” we mean they have spread their holdings over the full breadth of regions and countries contained in their benchmark, plus or minus whatever tilts their manager might have in an actively managed portfolio. In fact, the word “Global” appears in J.P. Morgan’s widely utilized benchmark for U.S. Dollar-denominated sovereign debt: the Emerging Markets Bond Index Global Diversified (EMBIGD).

This approach has worked out well for investors who have held their exposure over multiple market cycles. Over its 30-plus-year history, the EMBIGD has returned 7.7% annualized. And it has done so with 11.5% volatility, putting its Sharpe ratio in the upper ranks among fixed income asset classes.1

There have, however, been points in time when investors have expressed geographically focused views. In the years following the Soviet Union’s collapse, a number of so-called “Convergence Funds” provided concentrated exposure to the handful of recently liberated countries of Eastern Europe where expected structural improvements were supposed to lead to higher levels of growth, improved creditworthiness, and, of course, attractive excess returns. Most of these funds liquidated years ago as those countries matured, with some having achieved developed market income levels and even acceding to the Eurozone.

Funds focused on Emerging Asia bonds have been a longer-lived category. We trace their staying power to two factors. First, they appeal to the home country bias (or perhaps more precisely, home region bias) of the Asia-based investors who represent the majority ownership of these funds’ assets. Second, investors in many Asian countries have historically taken their fixed income exposure through line-item holdings of individual bonds. Moving to a fund format—where diversification is a byproduct of portfolio construction and where the objective is total return rather than coupon clipping—seems like a natural evolution in how these investors allocate to fixed income.

Unsurprisingly, the portfolio managers of many of these funds are based in Asia. This puts them in close proximity to the issuers—both countries and companies—whose bonds comprise their portfolios (perhaps, we should say “relatively” close proximity…Asia covers a huge chunk of the globe after all). Intuitively, the ability to spend more time, more frequently on the ground should provide some benefit to managers with a fundamentals-based approach.

There is one additional region that we think stands out for a focused allocation and one that has not yet really received much focus in terms of products available to investors. We believe the bonds issued by countries and companies in Central America, the Caribbean, and the other markets of Latin America present a compelling opportunity, albeit for different reasons than those mentioned above for Asia and Eastern Europe.

First, many of the smaller markets in the region tend not to be as well covered by either Wall Street or buy-side analysts. This should, in theory, lead to less market efficiency and more potential for both yield harvesting and excess returns.

Second, these markets encompass an impressive diversity of opportunities. Alongside the sovereign issuers that typically come to mind, bonds issued by quasi-sovereigns (i.e. state-sponsored enterprises) and private sector companies in the region provide another avenue for investors to harness Latin America’s economic vibrancy.

Third, local bonds—government or government agency securities denominated in or exposed to the currency of the issuing country—also tend to offer higher yields compared to U.S. Dollar-denominated debt. Although many Latin countries either employ some sort of managed exchange rate regime or have dollarized, investing in local markets offers yet another performance lever in select countries.2

That All Sounds Nice, but Is This “Good” Credit?

Of course, yield cannot be viewed as “attractive” without considering the credit risk one bears to earn it which, in turn, depends on fundamentals. Simply put, we like the sovereign fundamentals in Latin America.

The credit rating agencies have recognized several countries’ strong fundamentals: Mexico, Chile, Panama, Peru, and Uruguay are all pretty firmly in investment grade territory. However, others in the region tend to have lower credit ratings and thus higher yields. Nonetheless, there are a few key metrics that underpin our broad-based enthusiasm for Latin America.

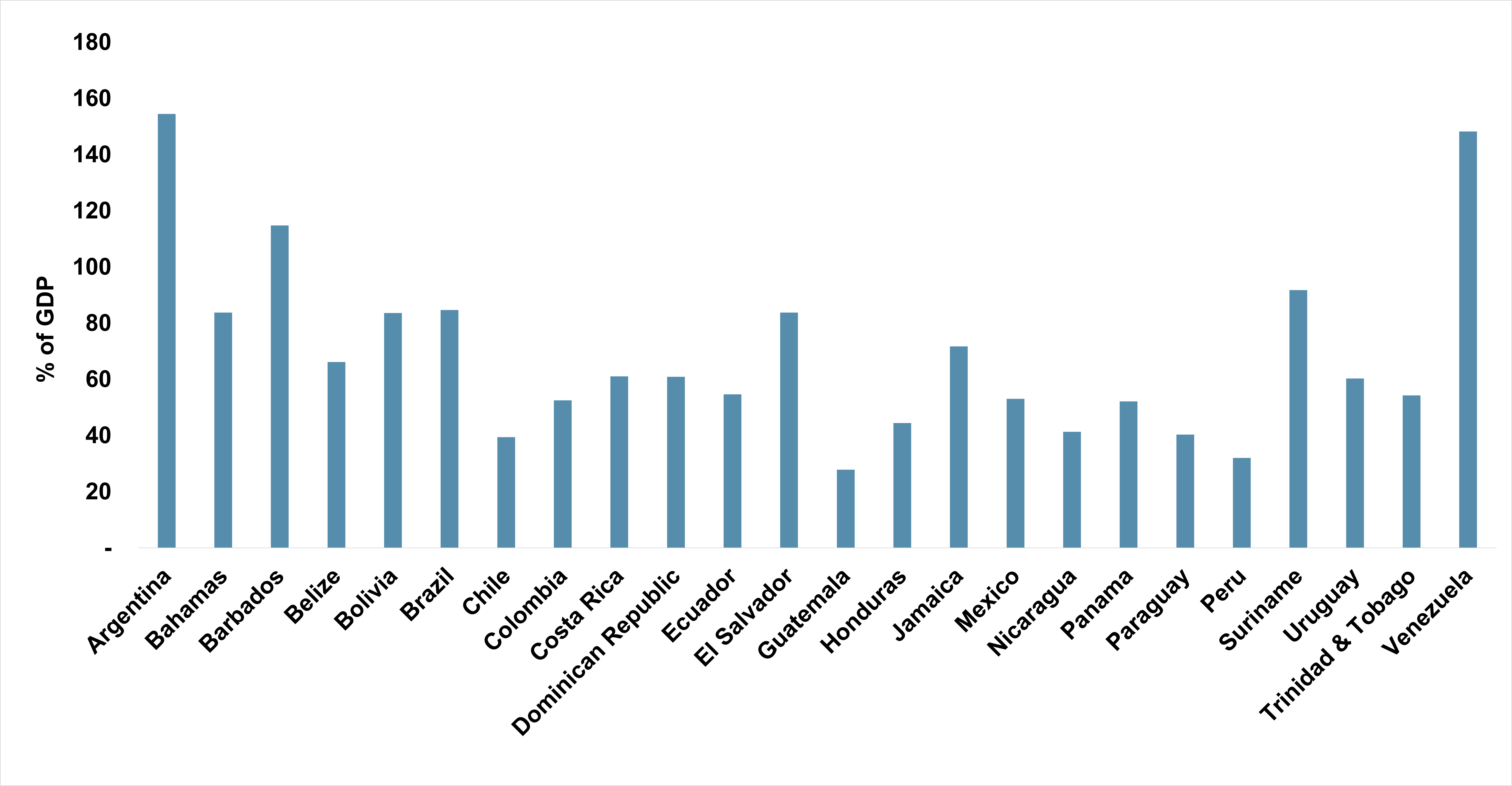

The first measure, shown in Figure 1, is the level of government indebtedness relative to the size of the economy, known as the public debt-to-GDP ratio. This ratio is a high-level indicator of the creditworthiness of a country: all else equal, a lower number can be thought of as implying a lower likelihood of a government default.

There is a wide range, around the ~70% average with Argentina and Venezuela straddling 150% and Guatemala at a modest 28%. However, the striking contrast is in relation to developed economies: U.S. public debt-to-GDP is 122% and the average for the G7 is a few percentage points higher. None of this should be interpreted as a prognostication of zero defaults, but many investors are surprised to learn that the levels of debt in many—actually most—EM countries are way below that of their developed market counterparts.

Figure 1: Public Debt-to-GDP Ratios, 2023

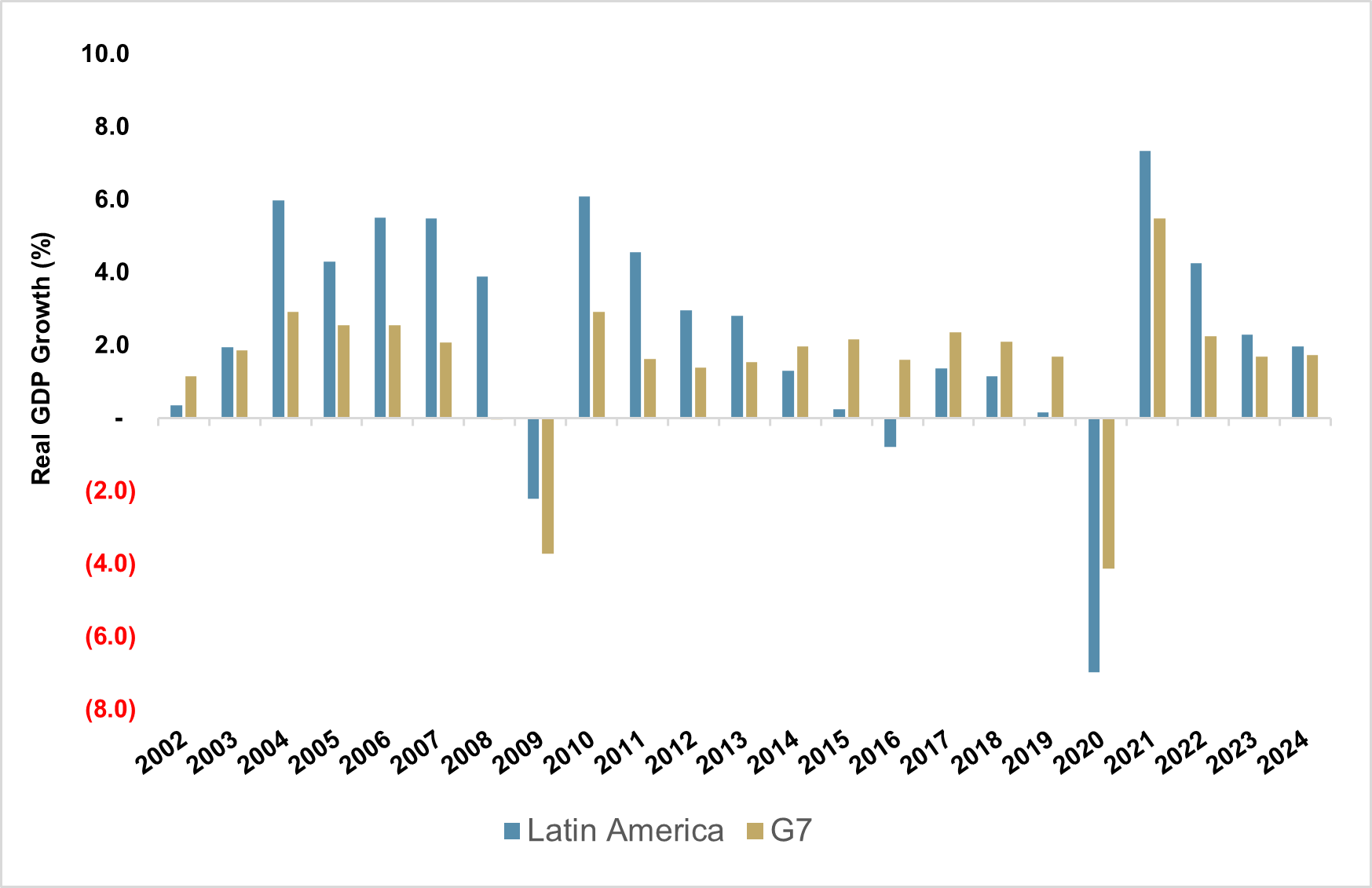

The second—and arguably more important—measure relates to Latin America’s growth profile. Growth has always been the foundation on which investing in EMD rests, underpinning the secular trend in improved sovereign creditworthiness. And as Figure 2 shows, Latin America has nicely outpaced growth in the G7 countries, averaging nearly two-and-a-half percent versus roughly one-and-a-half since 2001.

Figure 2: Latin American vs. G7 Growth Rates, 2002-2024

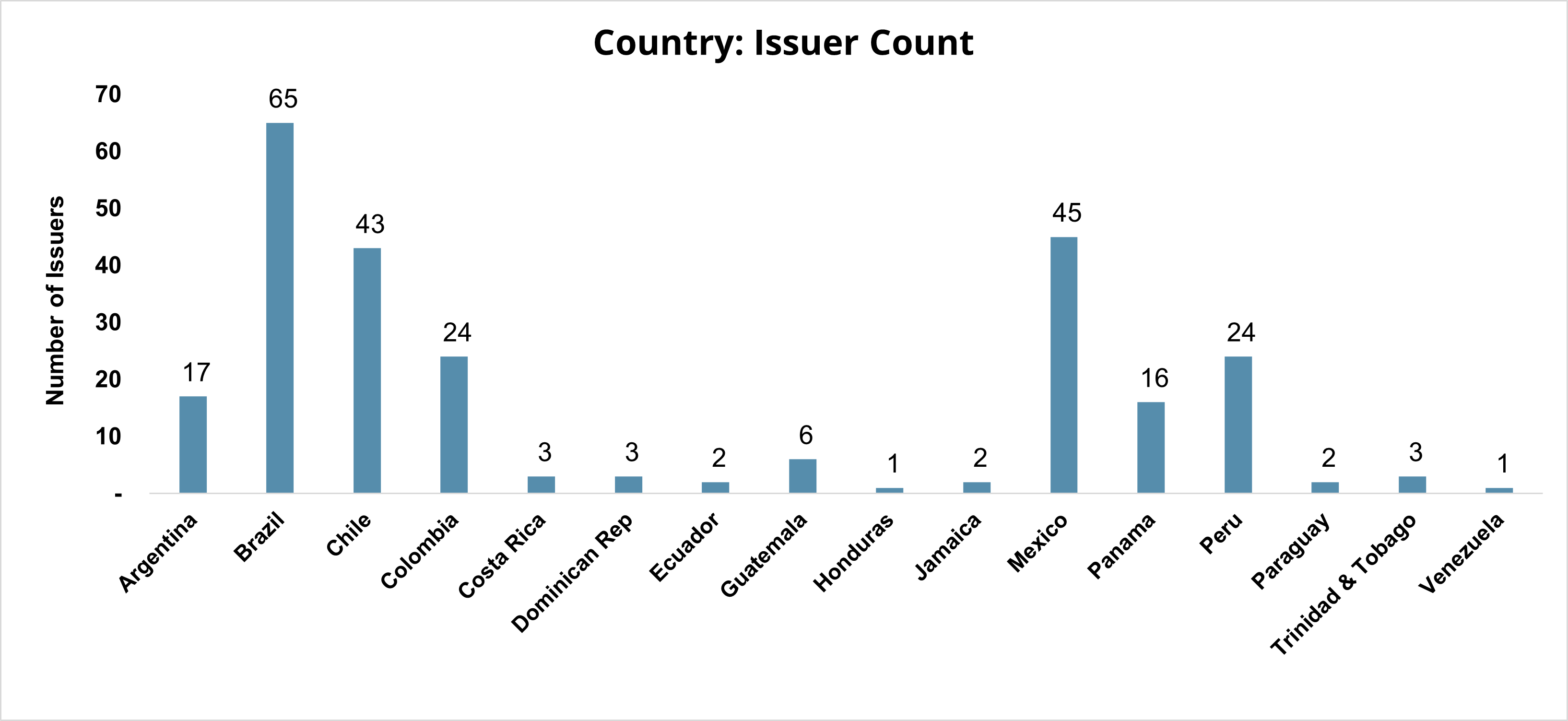

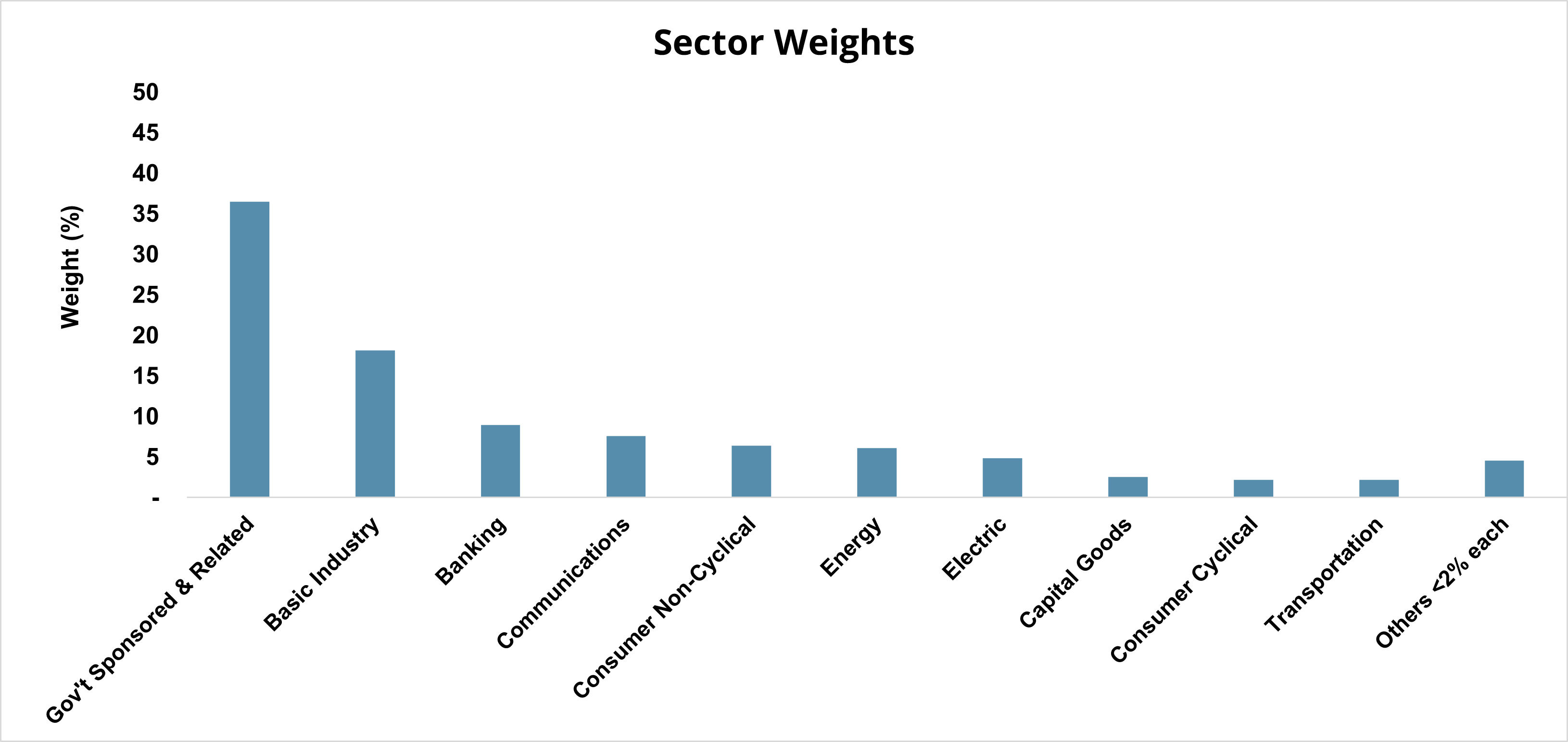

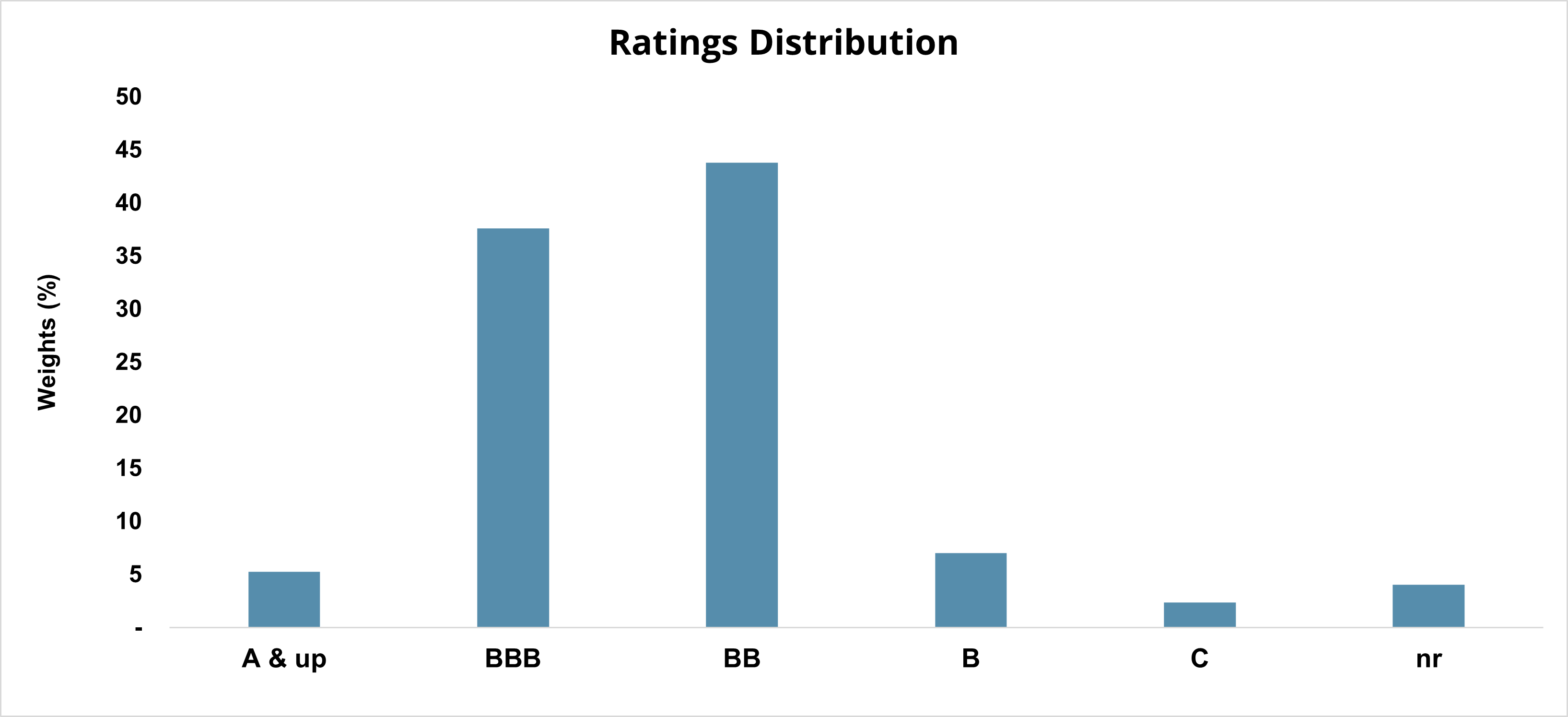

Third, as we turn from countries to companies, corporate bonds have proliferated in recent years as companies have increasingly tapped international capital markets to fund growth. As Figure 3 below highlights, the opportunity set is strikingly diverse across geography, sector, and rating.3

Figure 3: Breadth of Latin Corporate Bond Universe, Sep 2024

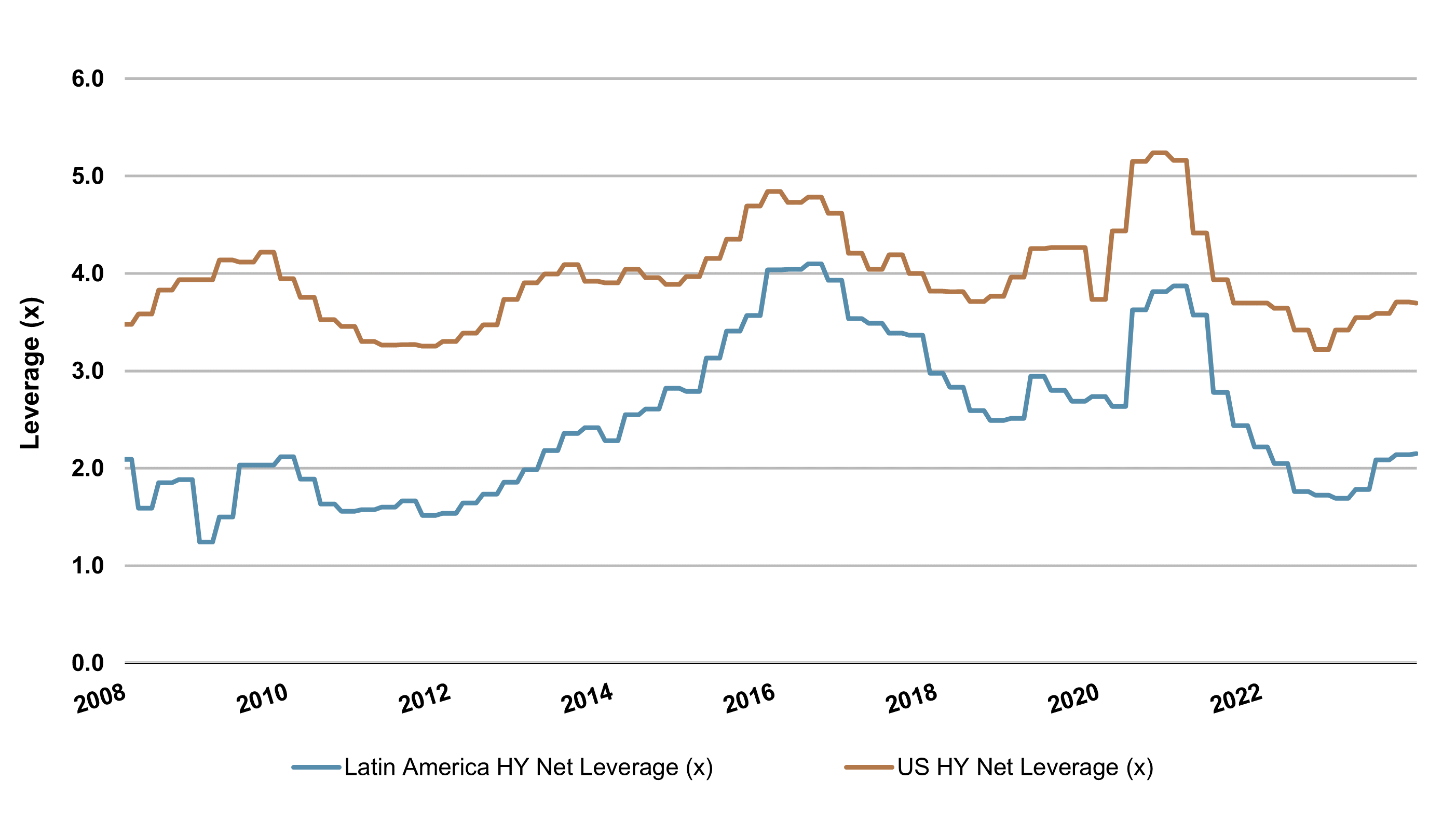

Fourth, sticking with our focus on fundamentals, we note that these companies tend to run their balance sheets more conservatively than their U.S. counterparts on average. Figure 4 shows the net leverage for high yield LATAM corporates at a full turn-and-a-half lower than U.S. corporates (2.2x vs. 3.7x). Again, if we interpret this leverage measure as one marker of creditworthiness, lower is—all else equal—an encouraging indication.

Figure 4: LATAM HY Corporates vs. U.S. HY Corporates, Net Leverage

Dec 2007 - Dec 2023

A Yieldier Credit Exposure

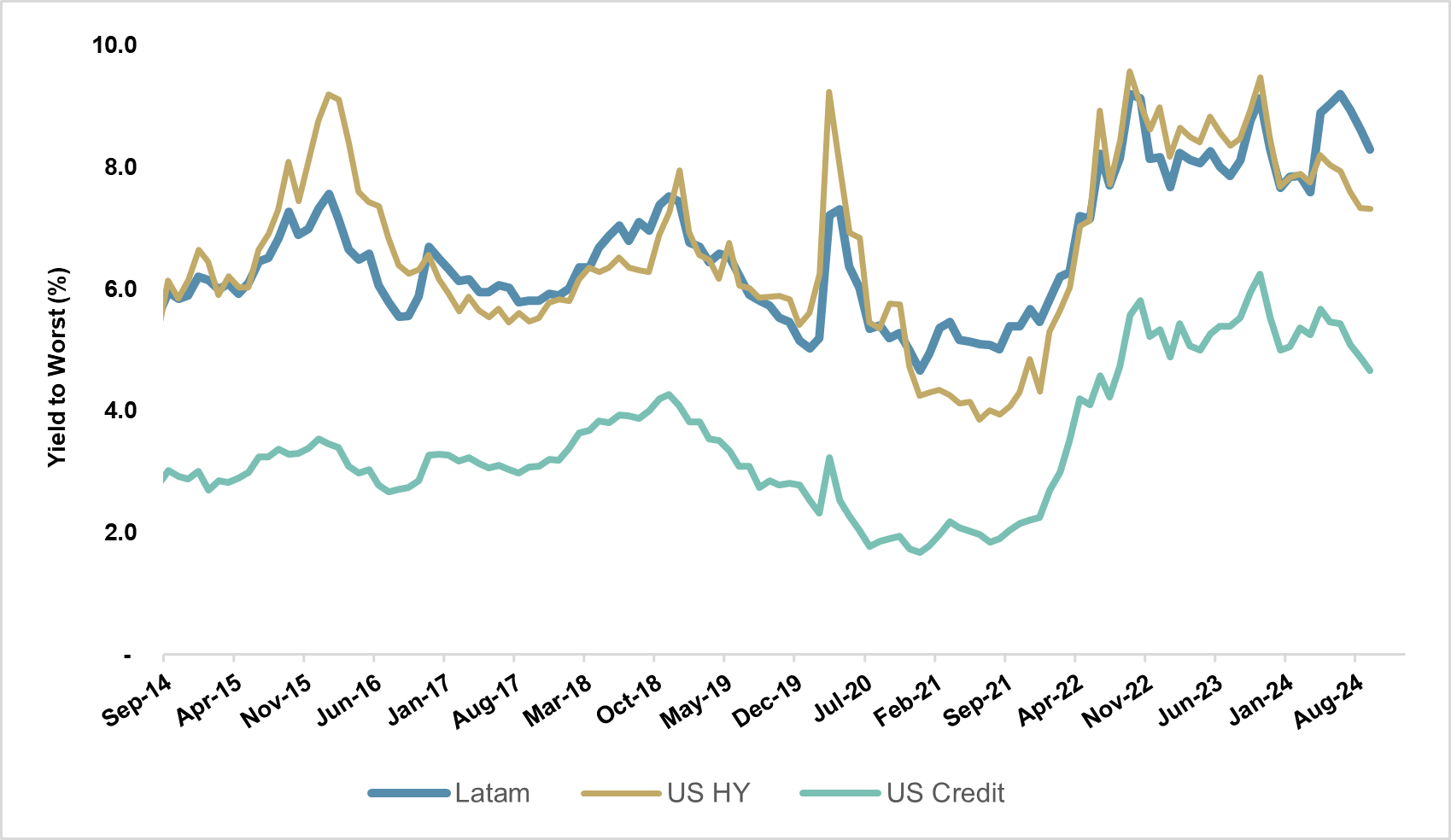

With some appreciation for the fundamentals, we can turn our attention to the other half of the risk/reward equation: what do we get paid for underwriting this risk? Figure 5 shows the yield for the Latin America subindex of the EMBIGD versus yields of the U.S. High Yield and Credit indices. Considering that the Latin subindex is almost evenly split between investment grade and high yield, these yields—picking up over 100 basis points versus High Yield and around 300 basis points versus Credit—seem attractive to us.

Figure 5: Latin Bonds vs. US High Yield & U.S. Credit

Sep 2014 - Sep 2024

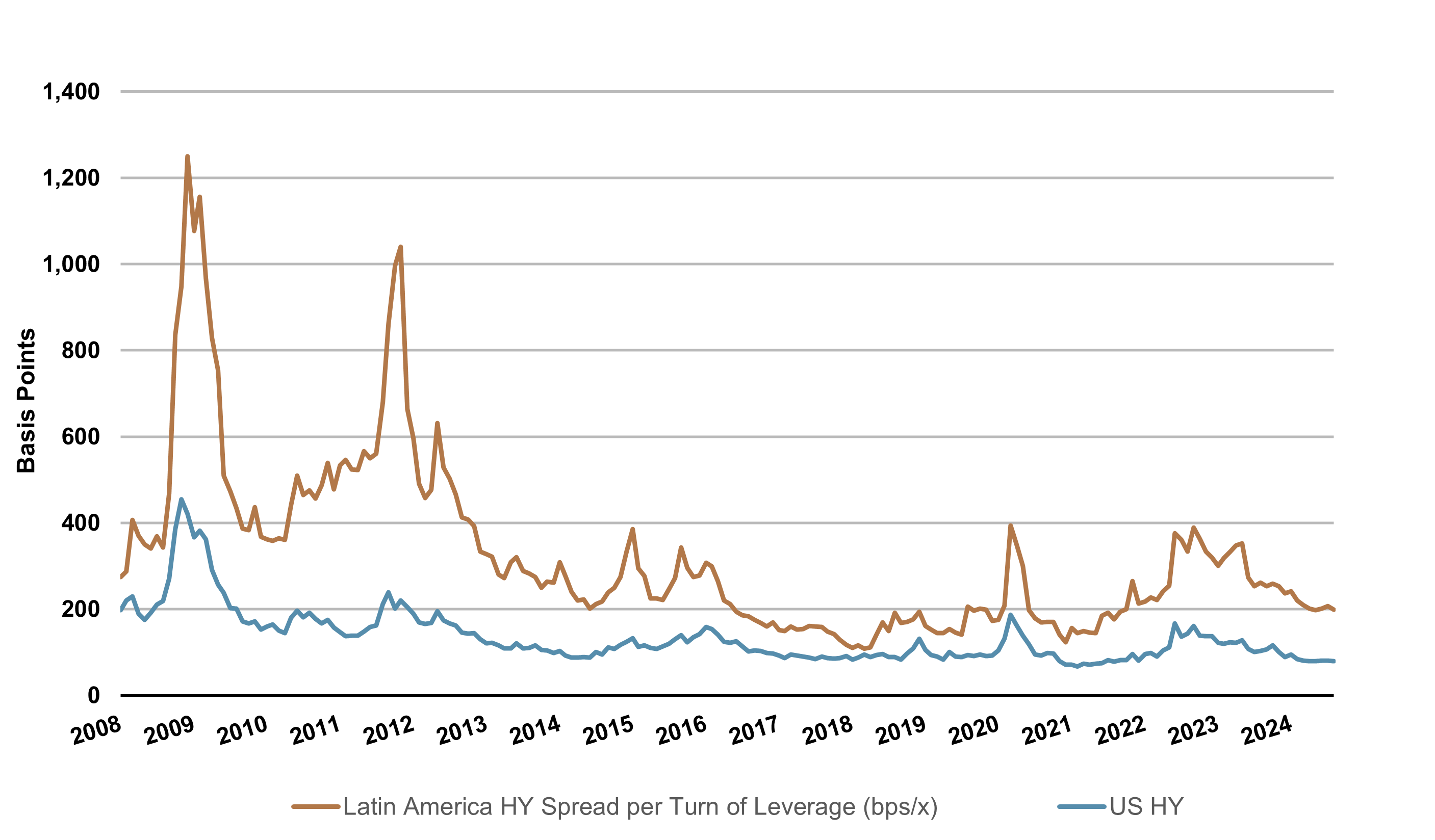

On the Latin corporate side, we can look at the value proposition in proportion to risk. Figure 6 shows the amount of spread per unit of leverage or put differently: compensation per unit of fundamental risk. While one can argue that EM corporates entail some additional risk by virtue of their location, the compensation for bearing that risk seems attractive.

Figure 6: LATAM HY Corporates vs. U.S. HY Corporates

Spread Per Turn of Leverage

Dec 2007 - Aug 2024

Our Approach

Simplify has partnered with Gamma Asset Management (Gamma) as the subadvisor for the Simplify Gamma Emerging Market Bond ETF (GAEM). Similar to the benefits that accrue to Asia bond fund managers who base themselves in-region, Gamma’s regionally distributed investment professionals and its deep engagement in the real, financial, and public sectors of these economies afford it unparalleled and real-time insights into developments that other investors—sitting in New York, London, or other financial centers—might miss.

We view Gamma’s on-the-ground presence as a key advantage, particularly in light of the ongoing growth of the asset class. Since the inception of the EMBIGD, the number of Latin sovereigns in the benchmark has more than tripled from seven to 22. On the corporate side, the crude and arguably conservative screen we used to produce the charts above turned up over 250 individual issuers and that number is constantly growing.

GAEM’s investment process starts off with a systematic screen. The team evaluates high and low-frequency economic indicators and corporate data to help identify which countries, companies, and currencies merit more exhaustive fundamental research, which to avoid, and which might be throwing up warning signs. For sovereign debt—both local and external—and currencies, this includes analyzing economic activity, debt dynamics, balances-of-payments, banking sector vulnerabilities, inflation and monetary policy, and politics. On the corporate side, the analysis examines balance sheet strength, sustainability of business model, and quality of management.

The goal of Gamma’s approach is to facilitate relative value comparisons across the full breadth of fixed income opportunities available in Latin America and to construct a portfolio of best ideas without being strictly beholden to a benchmark for a single segment of these very diverse markets.

Risk management is likewise an integral part of the process. The team employs a comprehensive and proactive approach. Traditional fixed income risk measures such as duration and sensitivities to interest rate and spread risks are paired with concentration limits on various risk factor exposures. Gamma also makes extensive use of market-based methodologies such as Value-at-Risk, scenario stress-testing, and liquidity monitoring.

Conclusion

We view focused exposure to the companies, countries, and currencies of Latin America as compelling. The less efficient nature of many of these markets lends itself to earning attractive carry. Also, improving fundamentals support the potential for capital appreciation to contribute to total return. However, we view a highly active approach—one guided by a rigorous investment process and one that can move nimbly within the opportunity set—as the most sensible approach to realizing the full potential of Latin America while sidestepping the credit events that can prove so harmful to investors.

1J.P. Morgan, as of September 31/24.

2Dollarization: the adoption of the U.S. Dollar as a unit of account, a medium of exchange, and a store of value. Dollarized countries typically cease issuing their own currency.

3Charts produced from a Sept 12/24 Bloomberg screen based on (a) min $50mn outstanding in US Dollars, (b) at least 1 year to maturity, (c) current pay status, (d) DTC-eligibility, and (e) rank: Sec, Sr Unsec, Unsec, Sub, Sr/Jr Sub, Sub. Weights for sector and ratings breakdowns based on prices available as of Sept 12/24 and are exclusive of accrued interest.

GLOSSARY:

Basis Points: A common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%.

Buy-Side Analysts: Analysts who evaluate an investment's potential and whether it aligns with a fund's investment strategy.

Carry of a Bond: The return obtained from holding it if the shape of the yield curve remains stable. For most fixed income securities, carry consists primarily of the coupon stream.

Dollarization: the adoption of the U.S. Dollar as a unit of account, a medium of exchange, and a store of value. Dollarized countries typically cease issuing their own currency.

G7: An intergovernmental political and economic forum consisting of Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States. Additionally, the European Union is a "non-enumerated member".

Sharpe Ratio: The ratio compares the return of an investment with its risk. It's a mathematical expression of the insight that excess returns over a period of time may signify more volatility and risk, rather than investing skill.

Value at Risk: A statistic that quantifies the extent of possible financial losses within a firm, portfolio, or position over a specific time frame. This metric is most commonly used by investment and commercial banks to determine the extent and probabilities of potential losses in their institutional portfolios.