Introduction

The classic 60/40 allocation is very intuitive. The 60% equity allocation provides the lion’s share of the returns as a simple yet effective exposure to broad economic growth. And no one wants too much risk, so the 40% bond allocation is a simple way to diversify the portfolio and avoid excessive risk. It’s a beautifully simple story with historical credibility.

But today’s investment landscape is much broader than just stocks and bonds. For the first time ever, alternative investment strategies are now available to the masses through the liquid, transparent, and tax-effective ETF wrapper. And these are the same exact strategies that pensions and endowments have used for decades to build some of the most attractive portfolios out there.

In this article, we review how a simple suite of alternative investments could be used as a replacement for a portion of the 40 to create superior portfolios.

The 60/40 Portfolio

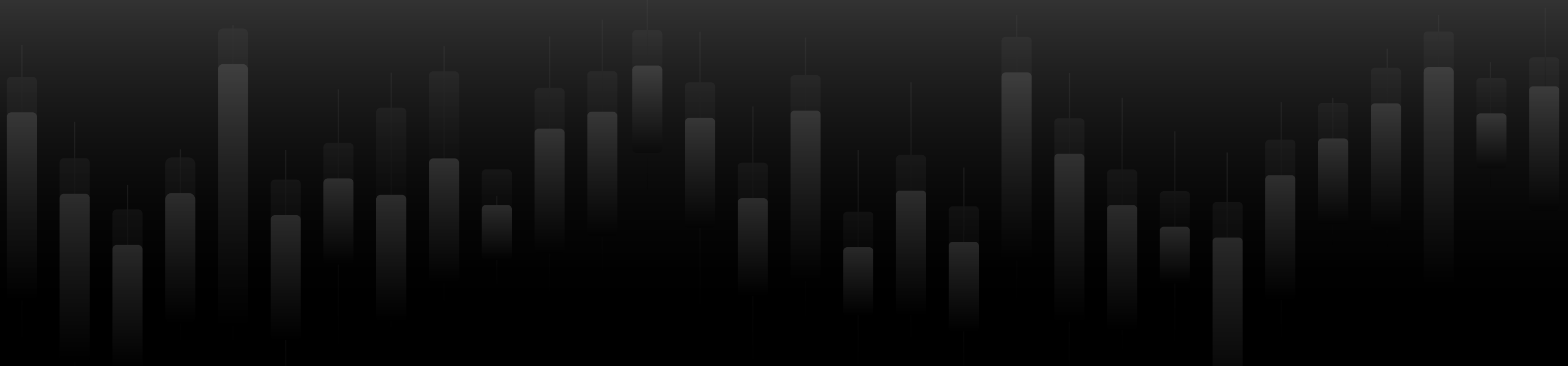

We begin by reviewing the performance of the 60/40 portfolio over the past 15 years in Figure 1. For the period ending December 2023 the 60/40 portfolio (60% S&P 500 Index / 40% Bloomberg US Aggregate Bond Index) had a total return of 300%, or 9.7% annually.

Figure 1: Stocks, Bonds, and the 60/40 Portfolio

(2009 – 2023)

Was the 60/40 portfolio a success over the past 15 years? On the one hand, investors with this allocation are probably not unhappy with the results: the portfolio had nearly 10% annual returns while still being able to minimize the steep equity drawdowns during the GFC and COVID-19. On the other hand, portfolio results would have been significantly better if the return contributions from the bond allocation weren’t so low (2.7% annually over this period) and if there was more to diversification than just two distinct asset types.

Why We Own Bonds

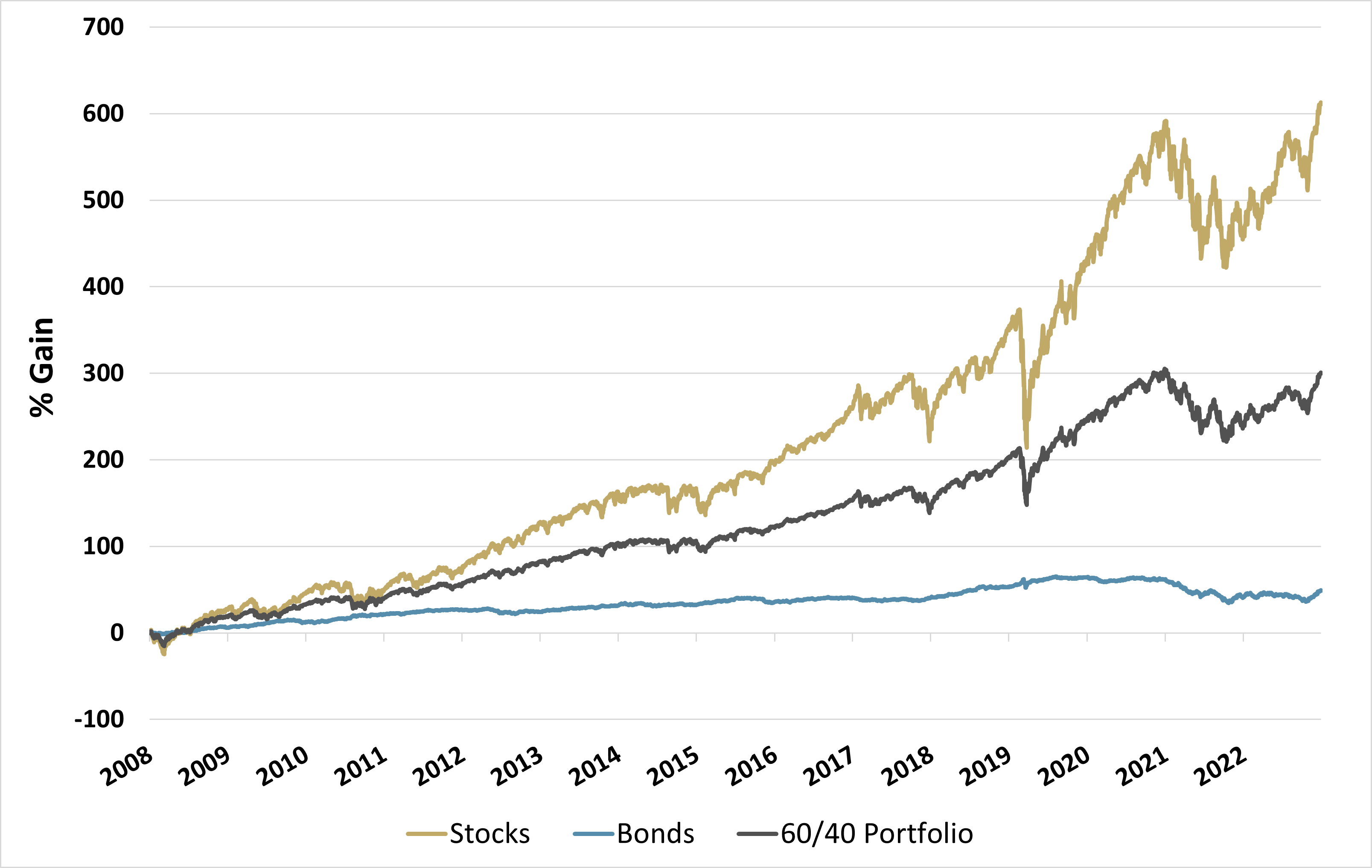

Bonds are a large component of portfolios because they have the potential to act as a useful hedge during large equity drawdowns. Figure 2 shows the total returns of the Bloomberg U.S. Aggregate Bond Index versus the S&P 500 Index during our four most recent stock market drawdowns. In each of these periods we can see that diversification into bonds worked with varying degrees of effectiveness.

Figure 2: Bond Returns During Equity Drawdowns

While bonds sometimes work as a diversifying hedge, we must keep in mind that they are a proxy hedge against equity risk, not an explicit hedge. There have in fact been many periods where negative stock returns have been accompanied by negative bond returns. A great example of this was the recent equity drawdown experience of 2022, which saw significant losses in both equities and bonds simultaneously (see last row of Figure 2).

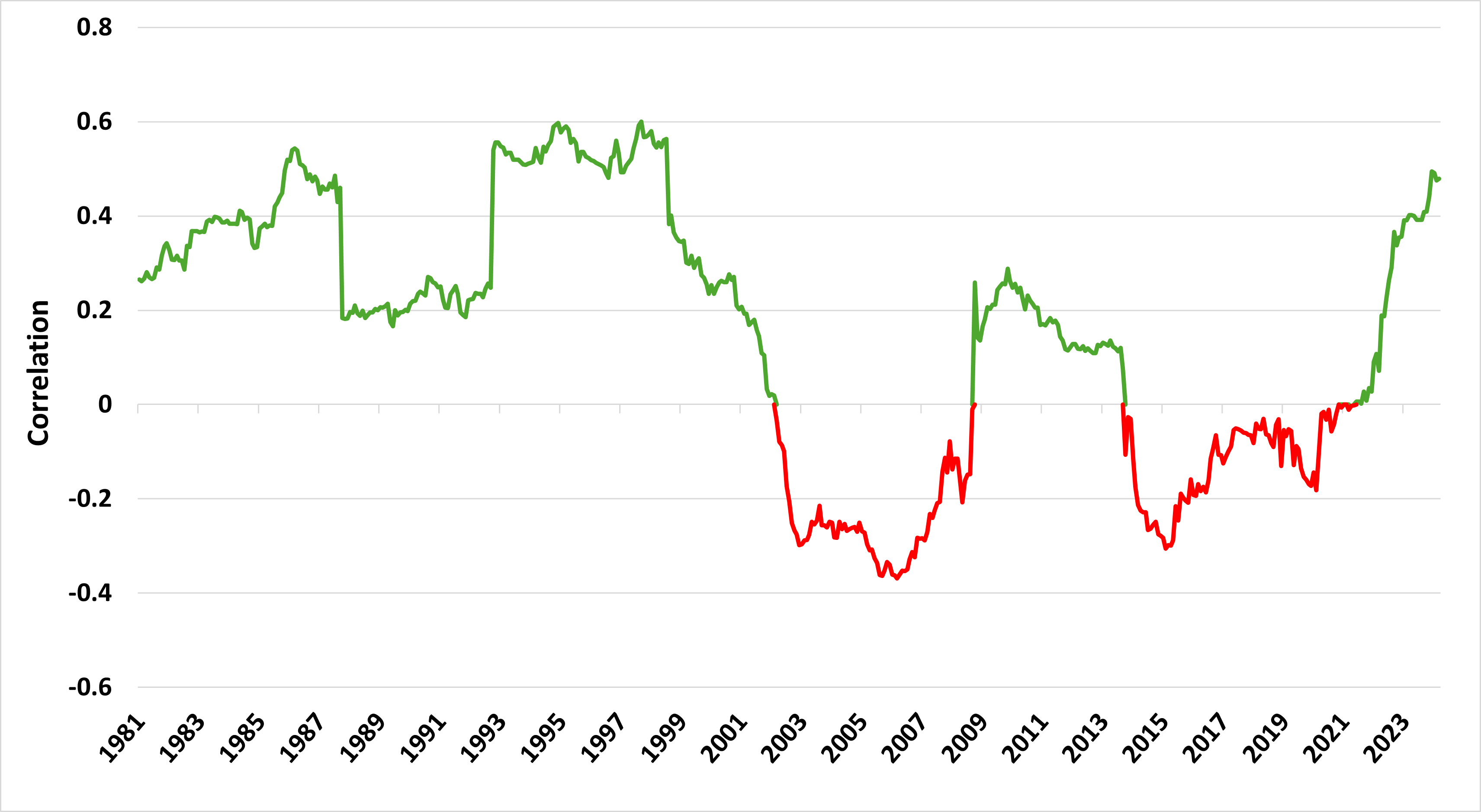

The effectiveness of bonds as an equity hedge is fundamentally dynamic. For instance, bond behavior relative to equities is very sensitive to both the interest rate and inflation environment at any given time. This dynamic can be quantified by looking at bonds’ correlation with equities (see Figure 3). We can see that bonds can go through long periods of time where their correlation with stocks is positive rather than negative.

Figure 3: Rolling 60-month Correlation Between Stocks and Bonds

If bonds have a tenuous benefit as a portfolio diversifier, and have significantly lower returns than equities on top of it, is there anywhere else investors should look to balance their equity allocations?

Alternative ETFs from Simplify

Simplify has launched a suite of alternative investment strategies that are designed to have low correlations to both stocks and bonds and can thus be used as portfolio diversifiers in lieu of bonds. For an in-depth review of the history of liquid alts and how Simplify is bringing institutional alternatives to the ETF wrapper check out our previous case study on the subject found on the Simplify home page:

That report goes into greater detail on the workings and rationale behind Simplify’s suite of alternative ETFs which include:

- Simplify Managed Futures Strategy ETF (CTA)

- Simplify Market Neutral Equity Long/Short ETF (EQLS)

- Simplify Multi-QIS Alternative ETF (QIS)

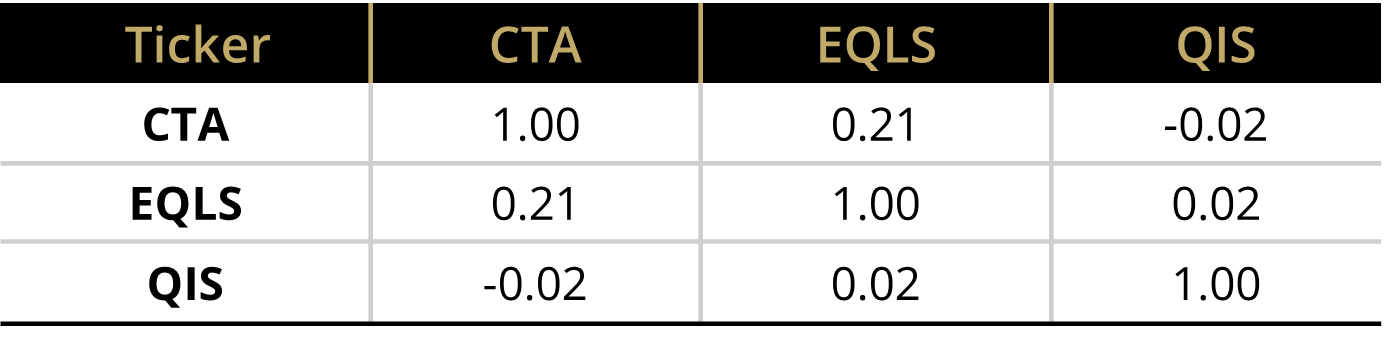

Each of these three alternative ETFs exhibit low – or even negative – correlations with both stocks and bonds, making them effective portfolio diversifiers (see Figure 4). Note that the starting date of historical analysis for these funds is constrained by the inception date of the youngest of the funds, EQLS, launched on 07/10/23.

Figure 4: Simplify Alternative ETF Correlations with Stocks and Bonds

(7/10/23 - 4/16/24)

Figure 5: Simplify Alternative ETF Correlations with Each Other

(7/10/23 - 4/16/24)

Another way to think about correlation benefits is to ask what happens to these alternatives on those days that stocks are down. Since the EQLS inception date of 7/10/23 there have been 83 days with negative stock market returns. An equal-weighted mix of the above three Simplify ETFs had positive returns on 55 of those 83 days (source: Portfolio Designer).

Introducing the 60/20/20 Portfolio

The 60/20/20 takes half of the 40% that was originally dedicated to bonds and allocates it to an equal weighted mix of CTA, EQLS and QIS. The resulting portfolio is comprised of:

- 60% Stocks

- 20% Bonds

- 6.67% CTA

- 6.67% EQLS

- 6.67% QIS

As you can see in Figure 6, the 60/20/20 has displayed superior return and risk metrics, including higher returns, lower volatility, smaller maximum drawdown, and higher Sharpe Ratio since the inception of EQLS. And to be clear, these alternative strategies were indeed designed to be both diversifying and provide strong returns, so that diversifying your core equity exposure doesn’t require sacrificing returns, as has been the case when using bonds as your sole ballast to equities.

Figure 6: 60/40 vs 60/20/20

(7/10/23 - 4/16/24)

It is also helpful to compare the performance of the 60/40 to this Simplify alts sleeve by itself, to build intuition on how it works as a new chess piece in your portfolio. Figure 7 shows us that the alts sleeve can really zig when the 60/40 zags, as evidenced during Q4 of 2023 and Q2 of 2024, while simultaneously providing absolute returns in other more “normal” periods.

Figure 7: 60/40 vs Simplify Alts Portfolio

(7/10/23 - 4/16/24)

The performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment returns and the principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. For performance data current to the most recent month-end please call (855) 772-8488 or go to https://www.simplify.us/etfs. For CTA standardized performance, click here. For EQLS standardized performance, click here. For QIS standardized performance, click here.

In Conclusion

The 60/40 portfolio was born during an era in which there were few alternatives, and those that were available were both inconvenient and expensive. Today there are many alternative choices in the highly accessible ETF format.

Given rising correlations to stocks, higher volatility, and uninspiring returns, it’s tempting to dismiss bonds entirely and consider replacing an entire bond allocation with alternatives. But just like bonds, alternative strategies are indirect hedges as well, and investors should diversify their diversifiers.

A reasonable starting point then would be to replace half of a bond allocation with a mix of alternative investments. An equal-weighted mix of CTA, EQLS and QIS shows great promise since inception as a diversifying complement to bonds.