Introduction

This paper presents the new Simplify Currency Strategy ETF (FOXY). Currency investing is a well-established corner of institutional investing that has the potential to provide stable returns while simultaneously diversifying traditional equities and fixed income. Foreign Exchange (FX) investing relies on different approaches to earn return from the appreciation of one currency versus another, and can be classified into two broad categories: fundamental and systematic. In this Fund Insights post, we will review the core principles behind both fundamental and systematic currency strategies, and then explore Simplify’s particular systematic approach to harvesting FX risk premia.

The Challenges of Fundamental Currency Investing

Fundamental investing in foreign exchange requires an outlook and value assessment, and perhaps most importantly, a lot of patience. Fundamental investors determine a currency’s relative favorability by analyzing an economy’s growth and inflation rates, fiscal outlook, political and central bank policy (including pegs and bands), technicals like market positioning, and financial measures (including external debt and trade balances). The perennial challenge with a fundamental approach in FX is that a currency can take a long time to revert to ‘fair value’, require significant capital, and encounter dampening impacts from market forces and policymaker actions (both verbal “jawboning” and unanticipated monetary policy changes). Adding even more complexity is that a target currency’s fundamental economic measures are all evaluated relative to another currency, and these ‘contra’ currency fundamentals can negatively impact the exchange rate movement of the target.

An example of fundamental FX investing would be to anticipate a specific currency’s depreciation over a short to medium-term horizon, like choosing to sell the British pound or Argentinian peso ahead of a potential financial shock. Another example would be to favor undervalued currencies based on the law of one price, i.e., that the same item such as a hamburger should cost a similar amount in all currencies (known as purchasing power parity).

Fundamental strategies can be successful but might experience challenges from two key observations that greatly inform our systematic approach:

Key Observation #1:

Developed (G10) currencies tend to mean revert. G10 market exchange rates heavily depend on monetary policy settings and relative adjustments by respective central banks. Because interest rates and inflation in major economies have converged in recent years, G10 exchange rates have experienced low volatility and an inability to trend toward fair value. This mean reversion tendency makes fundamental positioning across a pair or basket of G10 currencies difficult to maintain for extended periods.

Key Observation #2:

Emerging Market (EM) currencies tend to trend while also maintaining their yield advantage. Higher rates of inflation (often persistent) can drive a currency’s trend in one direction for long periods but are also subject to both internal and external shocks. As a result, returns to EM fundamental strategies have been lower than in other styles.

The Systematic Opportunity – Structural Alpha in FX

Styles of accessing structural alpha in FX will look familiar to style-based investors in equities and can be categorized into Carry, Value, and Trend approaches.

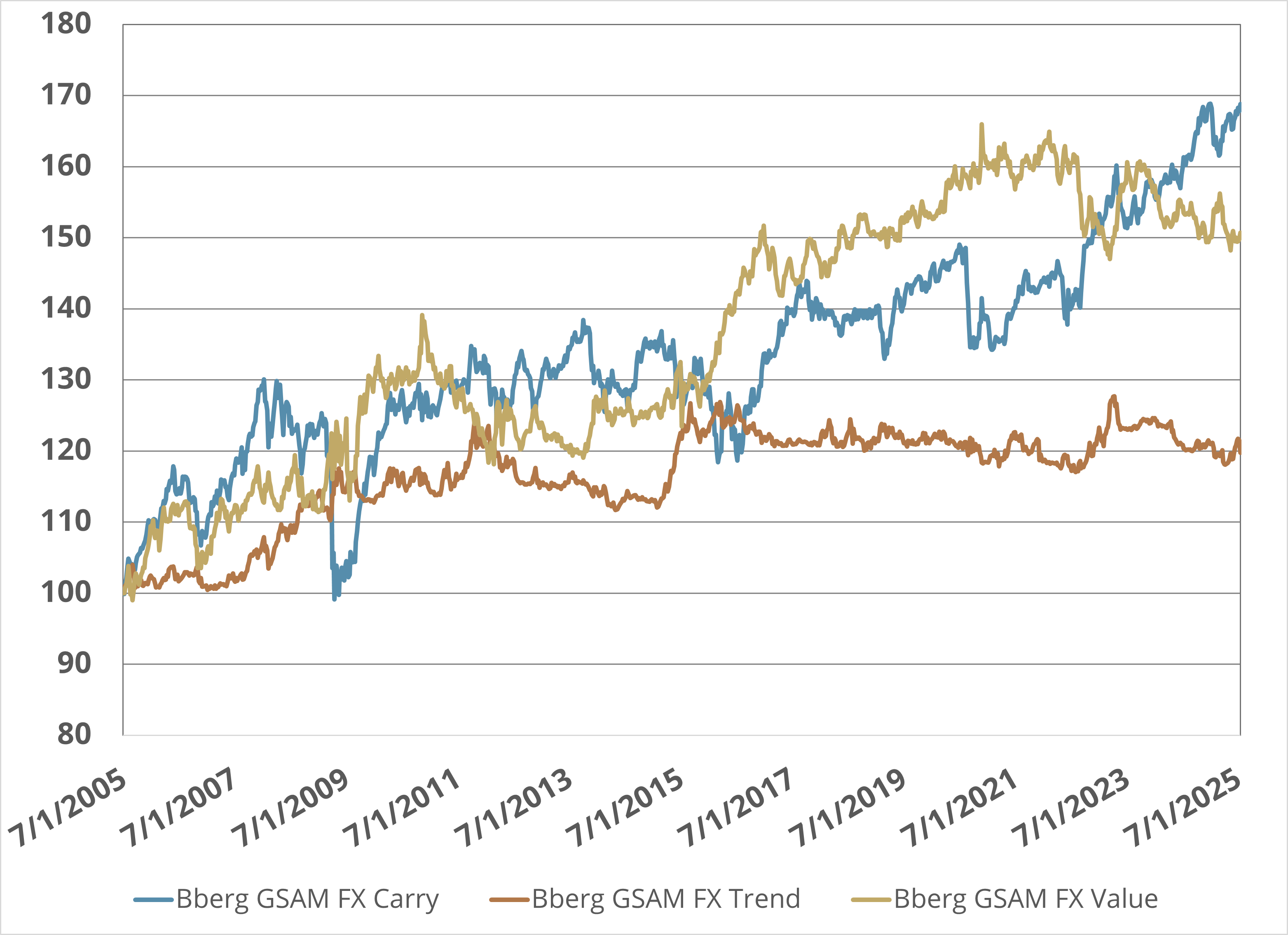

Carry is the return an investor earns if the currency spot rate remains unchanged or appreciates away from the weaker forward rate (depreciation in the case of shorts). Chart #1 below shows that since 2005, a carry-based approach has been the long-term return strategy which has generated the largest total return. However, risk-off episodes such as that experienced in the 2008 crisis show that a carry approach can undergo significant drawdowns. Rules for constructing the basket rely on multiple factors but generally involve buying a set of higher-yielding currencies while shorting a set of lower-yielders, with periodic rebalancing.

Value has had long-term success in generating returns and relies upon deviation from relative purchasing power parity and effective exchange rates. It is interesting to note that EM and G10 currencies generally experience similar performance results.

The chart below shows that Carry and Value frequently move in opposite directions, with one generating positive returns while the other underperforms and vice versa. This is a good example of the competing dynamic between systematic and fundamental styles mentioned above. During Carry drawdowns in 2008, 2015, and most recently, 2020 (Covid), Value gains offset shocks to Carry positions.

Trend-following is another commonly used method for selecting currency positions but has not shown effectiveness in producing consistent long-term returns. Some commodity currencies’ trends exhibit periods of strong risk-adjusted outperformance but fail to sustain these over longer periods. The relatively poor performance of a Trend or Momentum strategy is shown below in the orange line. Trend is a strategy employed by many commodity-trading advisors and typically focuses on a net long or short U.S. dollar position versus other G10 or EM currencies. This strategy can work, as accurate positioning to capture U.S. dollar appreciation like that experienced after the Covid pandemic and the ensuing economic recovery was profitable.

Systematic FX Style Comparisons

Past performance is not a guarantee of future results. For the most recent fund performance,

(855) 772-8488 or go to simplify.us/etfs. One may not invest directly in an index.

Simplify's Approach To Currency Investing

It is now time to bring it all together and review Simplify’s approach to building an FX portfolio. Based on our insights above, readers should not be surprised that we deploy differentiated approaches in EM and G10.

In EM, we combine a Carry strategy with a volatility-based weighting optimization. The selection set of available EM currencies includes the most liquid EM currencies while it generally avoids those where banks and other counterparties are unable to extend credit or establish material positions due to excess volatility. We then go long (short) the 4 highest (lowest) yielding currencies. Weights within the long and short EM buckets are then optimized so that the investor runs smaller exposure to higher volatility currencies, which has shown better risk-adjusted performance by virtue of the trend-following nature of these assets. These positions are sized so that U.S. dollar net risk is zero.

In G10, we observe FX implied yields to measure the degree to which the market is pricing a currency’s expected return relative to other currencies. Shorter-dated implied yields, specifically momentum dynamics, capture both local interest rate settings and capital flows which can indicate an oversold or overbought condition. G10 FX positioning using the implied yield momentum as an input emphasizes carry but also can capture the frequent reversion seen in dislocated currencies. We establish long positions in three currencies versus shorts in another three currencies and weight these using an optimization approach. These G10 positions are also sized so that U.S. dollar net risk is zero.

Finally, when combining the G10 and EM portfolios, an asset allocation decision at the bucket level is made. To this end, we weight the two buckets inversely proportional to the realized volatility of each basket. In periods of high volatility such as during a geopolitical turmoil or a systematic financial crisis, the model reduces exposure to high-volatility EM currencies, shifting focus to more stable G10 currencies. This approach not only reduces risk but also enhances returns by capitalizing on the relative stability of the G10 currencies relative to EM.

Parting Words

Thoughtful harvesting of FX risk premia may provide a powerful, diversifying return stream to traditional equity/bond portfolios. Simplify’s currency strategy intelligently aggregates the most important features in currency investing into a singular FX strategy that can be used strategically in portfolios.

GLOSSARY:

Alpha: An investment strategy's ability to beat the market, or its "edge." Alpha is thus also often referred to as “excess return” or the “abnormal rate of return” in relation to a benchmark, when adjusted for risk.

Carry: The return obtained from holding an asset assuming the underlying price of the asset remains stable.

Spot Rate: Reflects real-time market supply and demand for an asset available for immediate delivery.

Volatility: A measure of how much and how quickly prices move over a given span of time.