Why Newly Issued MBS Now?

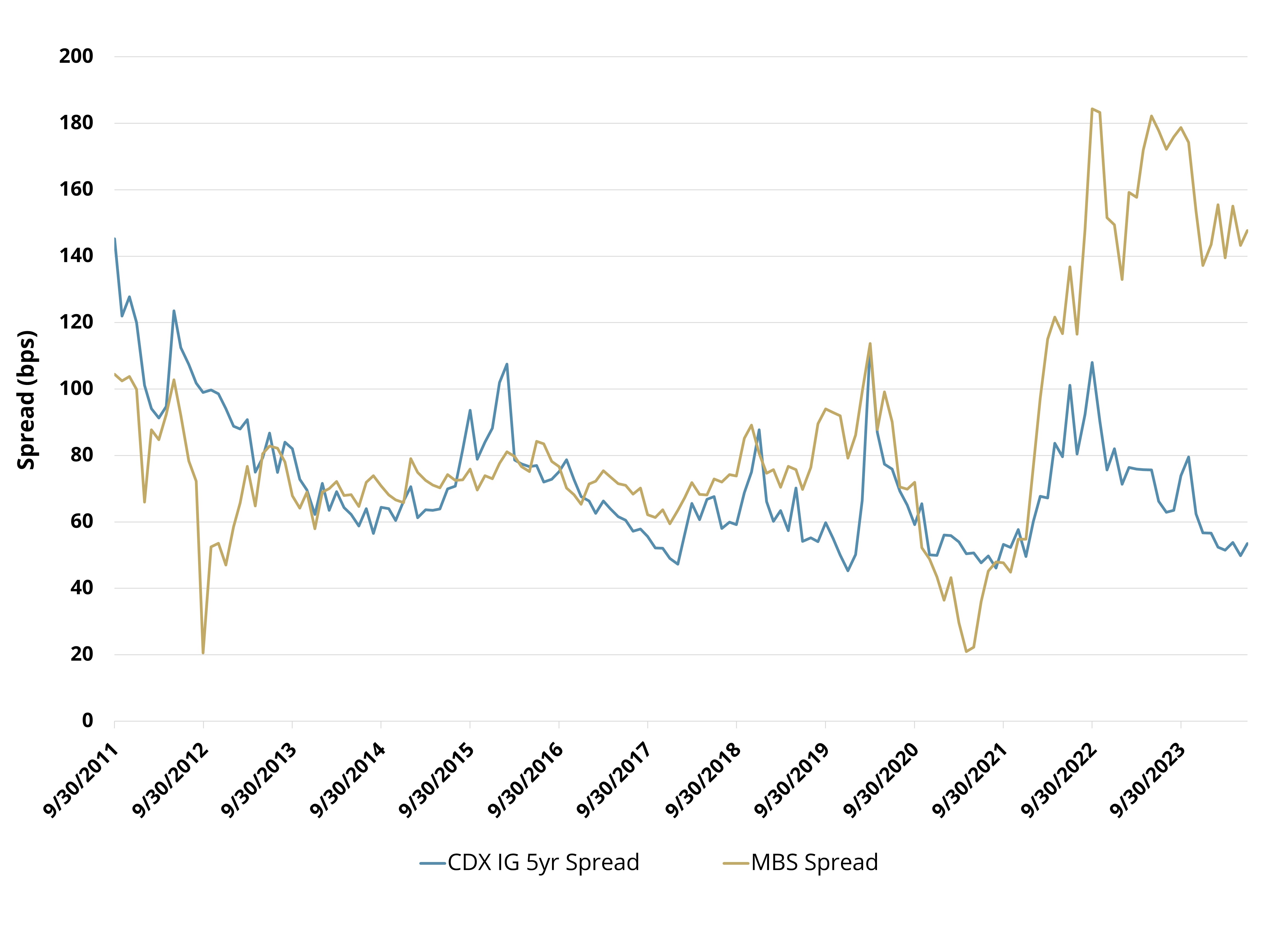

The Federal Reserve Bank (FED) hiked rates by 525bps over a nearly two-year period, providing attractive yields across all fixed income asset classes. But mortgage-backed securities (MBS) spreads are trading substantially wider (higher yield) than their historical averages (see Figure 1). Within the MBS space, newly issued MBS look the most attractive right now, which have coupons ranging from 5.0% to 6.0%, providing higher yields and shorter duration than the MBS Index which holds legacy MBS that were issued over the last 30 years.

Figure 1: MBS Spreads

Also consider that Investment Grade (IG) corporates are trading at historically tight levels, with 5-year IG CDX currently trading below 50bps, after trading over 90bps in March 2023 during the banking crisis, so not much upside at this point in the cycle. Additionally, even if the FED’s next move is a cut, they are in no rush to start cutting as their most recent Dot Plot shows only one cut for 2024. The cutting cycle will likely be gradual (every other meeting) once it starts and will mostly impact front-end rates with back-end rates more influenced by fiscal policy and the economic outlook, likely insulating mortgages that are based on U.S. 10-year rates.

MTBA

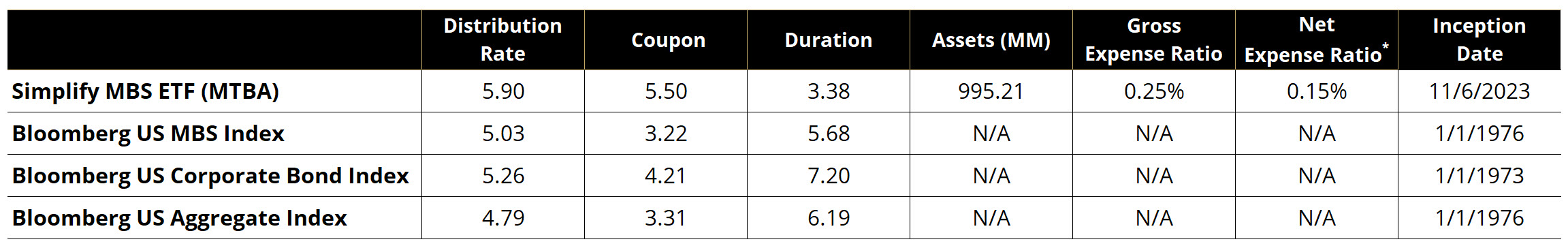

As you can see from Figure 2, newly issued MBS as executed in MTBA is providing higher yield and less duration than the traditional MBS index, as well as Corporate and Aggregate indices.

Figure 2: Comparison of Fixed Income

(As of 07/16/2024)

*The Fund’s adviser has contractually agreed, through at least October 31, 2024, to waive its management fees to 0.15% of the Fund’s average daily net assets.

The performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment returns and the principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. For performance data current to the most recent month-end please call (855) 772-8488 or go to simplify.us/etfs. For the prospectus and standardized performance, click here.

Three Portfolio Use Cases for MTBA

1) For those seeking a higher yielding/lower duration substitute

for mortgage index funds

2) As a complement to an existing core fixed income allocation

3) A defensive alternative to credit risk with attractive yields

In Conclusion

MBS, especially newly issued MBS, are offering great value relative to many other fixed income asset classes right now. And with expectations of a gradual cutting cycle, focused on the front-end, now looks like a great time to consider the simple yet powerful exposure to MBS that is executed inside MTBA.

View MTBA Fund Insights Video Recap

GLOSSARY:

Basis Points: A common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%.