Introduction

High yield bonds are corporate bonds issued by non-investment grade issuers. Typically, these companies’ bonds will offer a meaningful additional return in exchange for the additional risk. While these bonds often have a higher risk of default or impairment, the higher yield has historically been more than enough to compensate investors and generate higher returns than investment grade corporate bonds over an investment cycle.

With the Federal Reserve signaling an intention to cut interest rates, now may be an ideal time for investors looking to lock in higher yields for an extended term. High yield investing is popular with investors looking for a high level of income from a bond portfolio. The credit risk in high yield bonds tends to have more volatility and credit spreads can widen swiftly during periods of market stress, wiping out income quickly. Investors in this asset class can accept this risk and size their allocation accordingly or choose to hedge some of the risk to limit the downside when credit spreads widen.

In this Fund Insight, we discuss how deploying credit hedges directly in the portfolio can help protect it when credit spreads widen. The Simplify High Yield PLUS Credit Hedge ETF (CDX), the first-ever high yield ETF with a credit hedge overlay, is primarily used to generate income. It combines high yield bonds with credit hedge overlays to reduce risk.

What Happens When Credit Spreads Widen?

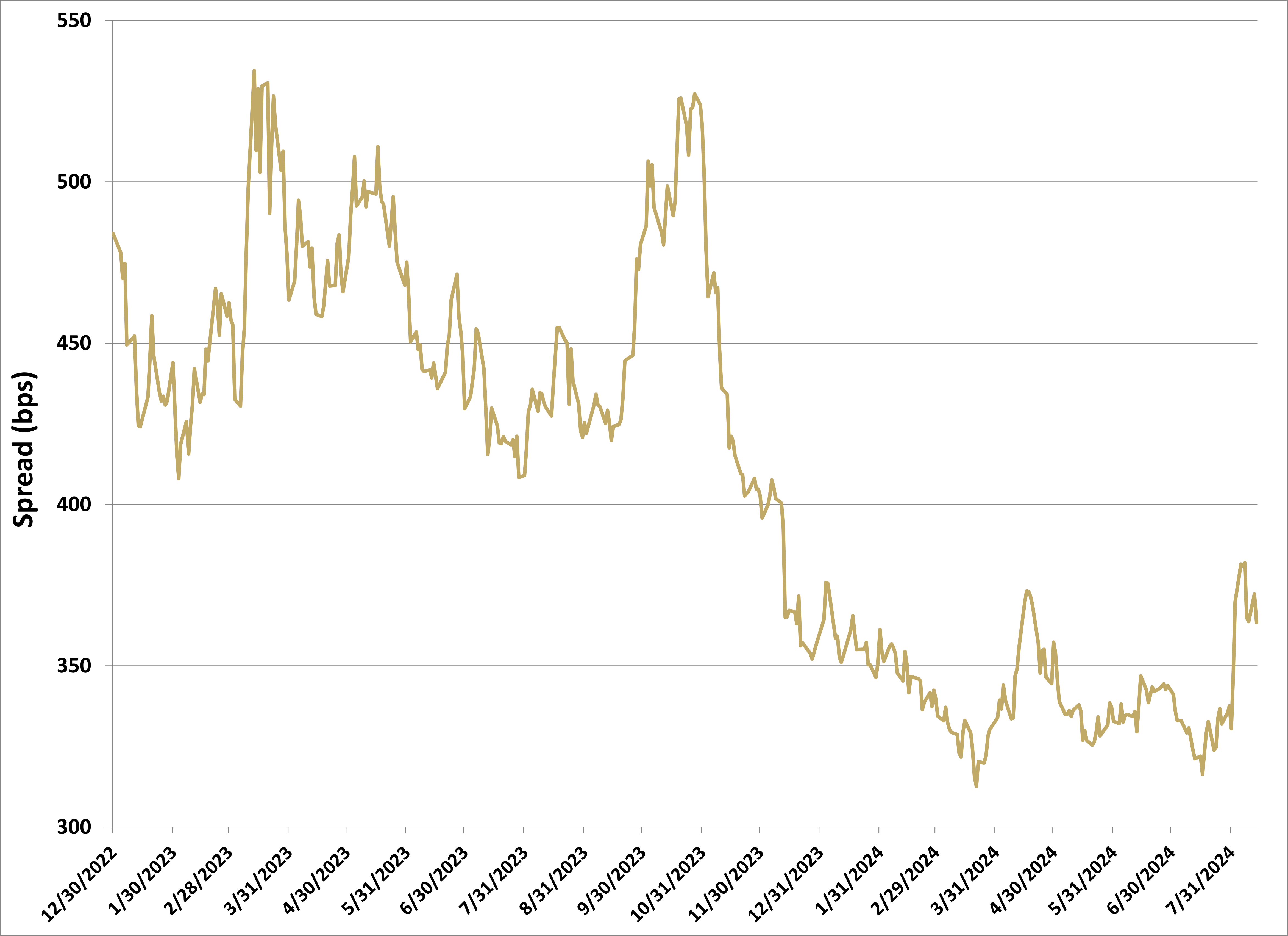

After the banking crisis in March 2023, high yield credit spreads widened to over 530 basis points (bps). Many investors saw this as an opportunity to increase their allocations to high yield bonds at these wider spreads and more attractive yields. These credit spreads did come down by more than 100bps last summer then widened back out to over 520bps in the fall, highlighting the volatility in these bonds. Spreads again narrowed at the end of last year and reached a low of just above 310bps this year in March 2024 as the economy seemed to be gliding to a soft landing.

With resurgent recession fears after a weak jobs report and equity market volatility in July 2024, spreads again widened out to the mid to high 300s (see Figure 1). During each of these periods of credit spread widening, CDX held up well - outperforming the iBoxx High Yield Index due to the credit hedges in the portfolio. During periods of credit spread tightening, CDX modestly underperformed as expected. The combined performance highlights the potential benefit of a hedged credit fund (see Figure 2) even during a period where credit spreads tightened overall.

Figure 1: 5-Year HY CDX Index Credit Spreads

Figure 2: CDX ETF and iBoxx HY Index Total Returns vs.

5-Year HY CDX Index Spreads

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. In addition, investment returns and the principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. For performance data current to the most recent month-end, please call (855) 772-8488 or go simplify.us/etfs. For standardized performance, click here.

Compelling Credit Hedge Overlays

CDX deploys credit hedging techniques to mitigate credit risk. Credit hedging can be expensive, so it is important to have a flexible approach that seeks to protect the portfolio when credit spreads widen. CDX has a full suite of credit hedges due to a complete ISDA agreement with prime brokers and will opportunistically use the following credit hedges: Credit Default Swaps (CDS), Credit Default Index options (CDX calls), equity puts, and a proprietary Quality-Junk factor-based hedging.

The primary tool is our Quality-Junk factor hedge, utilizing a basket of long high quality equities while being short a sector and size matched basket of “Junk” equity names. Quality equities have high margins, profit stability, and strong balance sheets while junk names are generally those stocks with high sensitivity to an increase in debt refinancing costs. While not a direct credit hedge, the Quality-Junk overlay has a high correlation with credit spread widening even as the higher yield and lower volatility of these equities have historically generated a positive carry (see Figure 3).

Figure 3: Quality-Junk overlay versus High Yield Credit Spreads

As an additional layer of protection, CDX has the ability to deploy credit hedges with a direct tie to credit markets, like CDS, CDX and CDX options. Using these credit hedges helped dampen the performance hit to CDX during the periods of credit spread widening (see Figure 4).

Figure 4: CDX ETF vs. HY Benchmark Indexes,

Cumulative Total Returns, 12/30/22 to 8/12/24

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance data quoted. In addition, investment returns and the principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. For performance data current to the most recent month-end, please call (855) 772-8488 or go to simplify.us/etfs. For standardized performance, click here.

In Conclusion

Investors looking to maximize current income by investing in high yield bond portfolios can benefit from a strategy with potential for attractive income while mitigating the credit risk. The reduced volatility and potential additional return helps those investors stay the course with their high yield holdings. CDX combines high yield bonds with credit hedge overlays to provide an investment with a hedged credit exposure. This provides insurance in times of stress when credit spreads can be volatile and widen sharply.

GLOSSARY:

Basis Points: A common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%.

CDX: A benchmark index that tracks a basket of U.S. and emerging market single-issuer credit default swaps.

Credit Default Swap (CDS): A financial derivative that allows an investor to swap or offset their credit risk with that of another investor.

Quality Minus Junk: The return of a basket of 100 stocks whose bond rating is investment grade minus the return of 100 stocks whose bond rating is below investment grade (junk).

Spread: The difference or gap between two prices, rates, or yields.