Alternatives

Alternatives

Demystifying Alternative Investments

Introduction

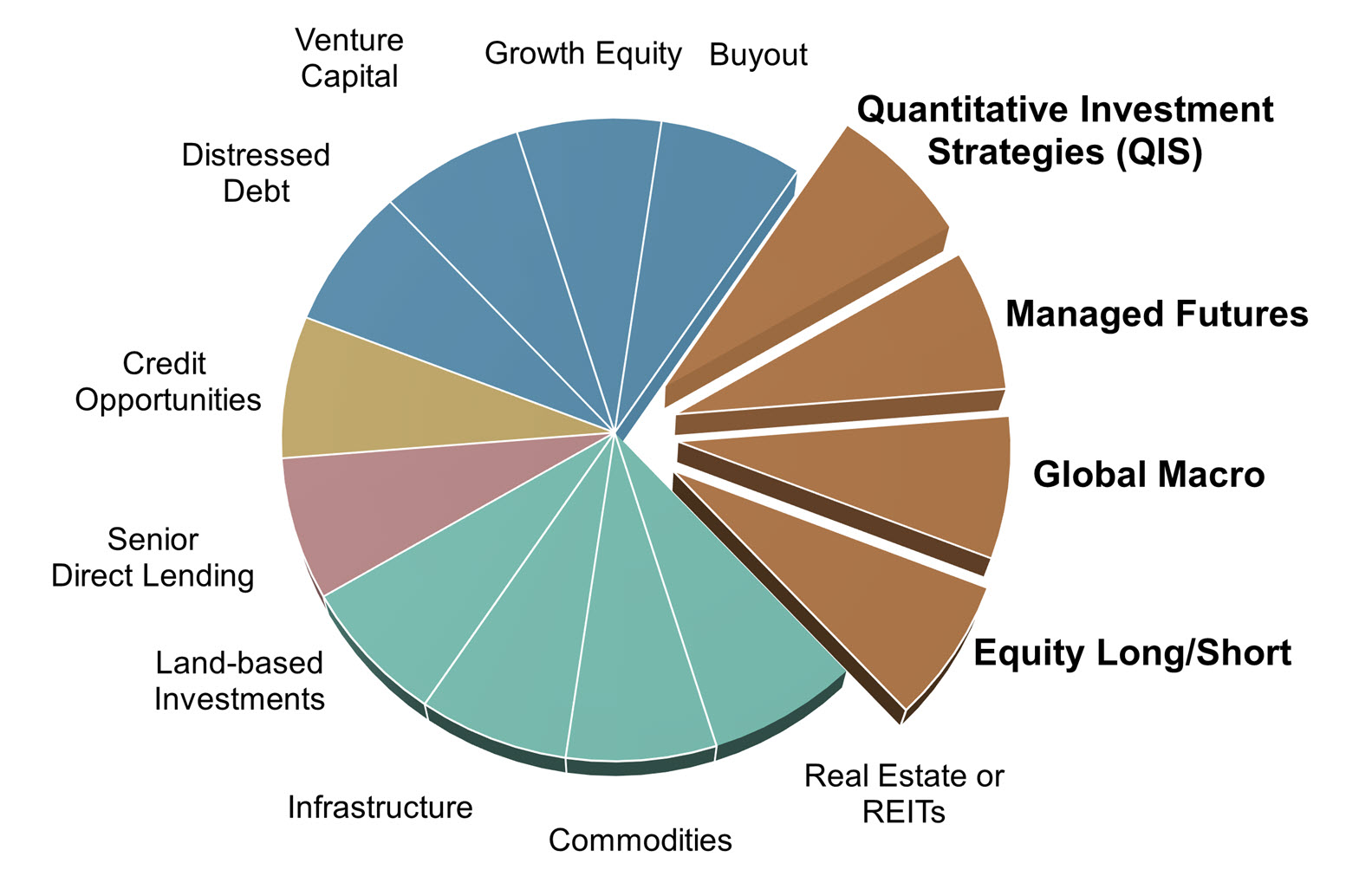

Alternative investments, or "alts," have emerged as a compelling solution for those seeking differentiated, attractive absolute and risk-adjusted returns beyond traditional equities, fixed income and cash. Although alternative strategies have grown precipitously to over $22 trillion as of 2023, they remain less than 15% of the total assets under management globally.1Alts have their own unique set of risks and challenges which we seek to demystify in this article by shedding light on the role alts play within a broader portfolio, the specific risks they introduce, and how one should expect to be compensated for those risks.

Certain alt asset classes (e.g., real estate, private equity or credit) offer investors exposure to inherently illiquid asset classes, a risk which may not be prudent for some portfolios. On the other hand, liquid alts can provide the key benefits of alts while maintaining the liquidity profile of traditional investments by limiting their investment universes to liquid instruments. This article will focus on liquid alts, a subset of the broader alts universe, which comprises a diverse set of approaches without sacrificing liquidity.

Analyzing Risk and Return

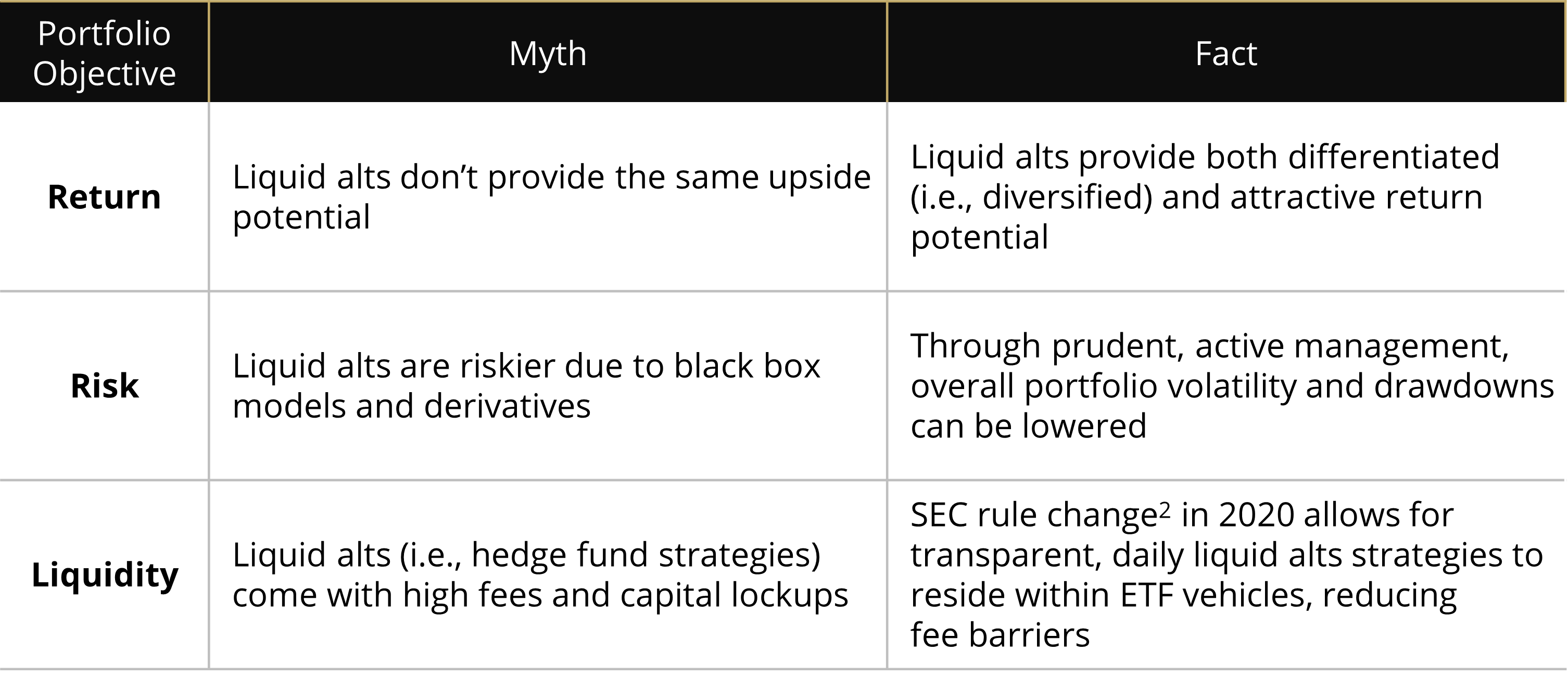

The table below outlines common misconceptions which have resulted in many investors ignoring this compelling asset class. Liquid alts are often categorized by "below market returns", "high risk", and "illiquidity". Instead, many liquid alt strategies offer high and differentiated return streams, healthy risk management which can limit portfolio drawdowns given their diversification properties and lastly, ample liquidity through underlying daily liquid instruments and vehicle wrappers such as ETFs.

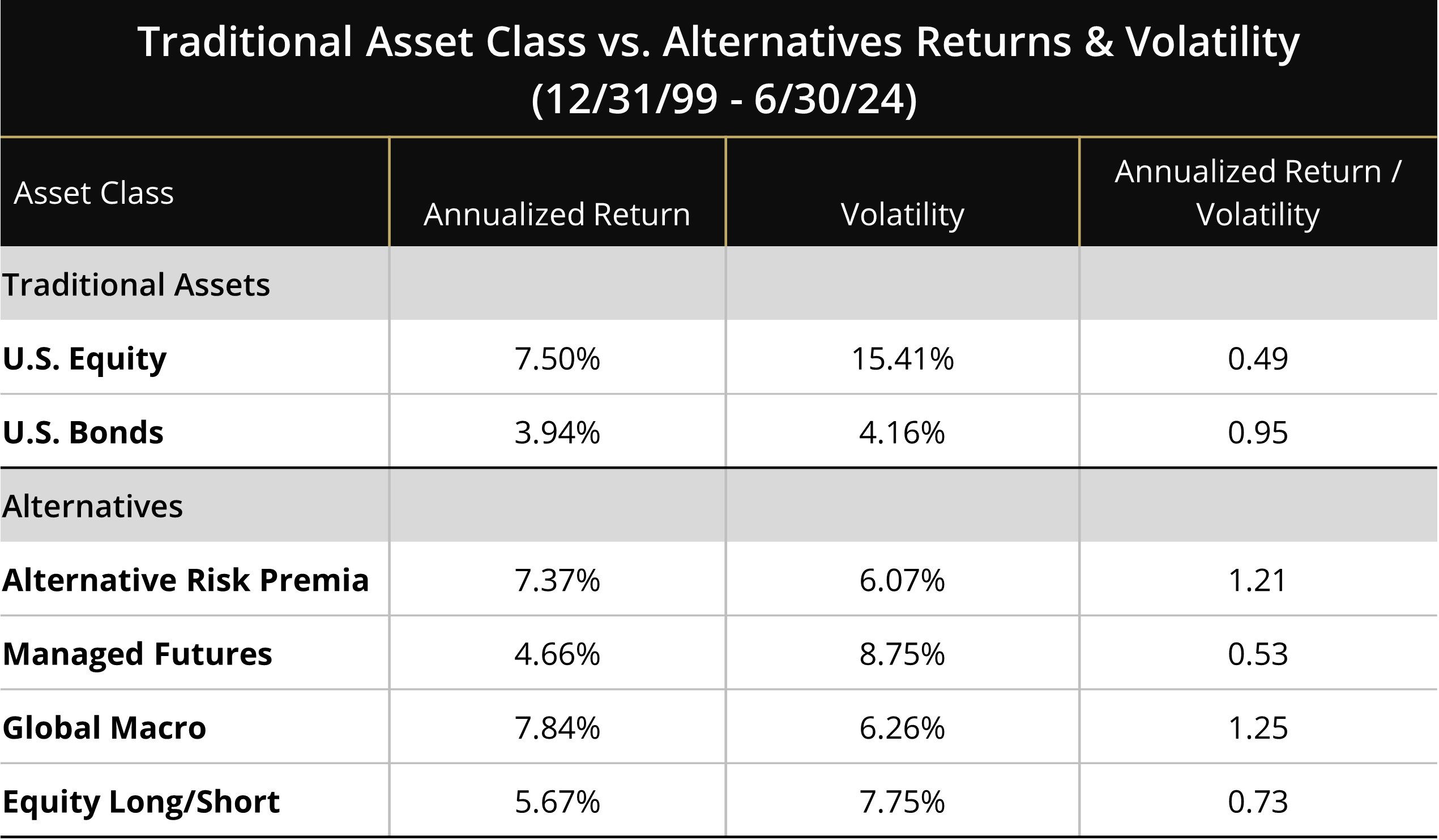

Figure 3 below outlines the risk and returns of a variety of traditional and alternative benchmarks since 2000.

Assets vs. Alternatives

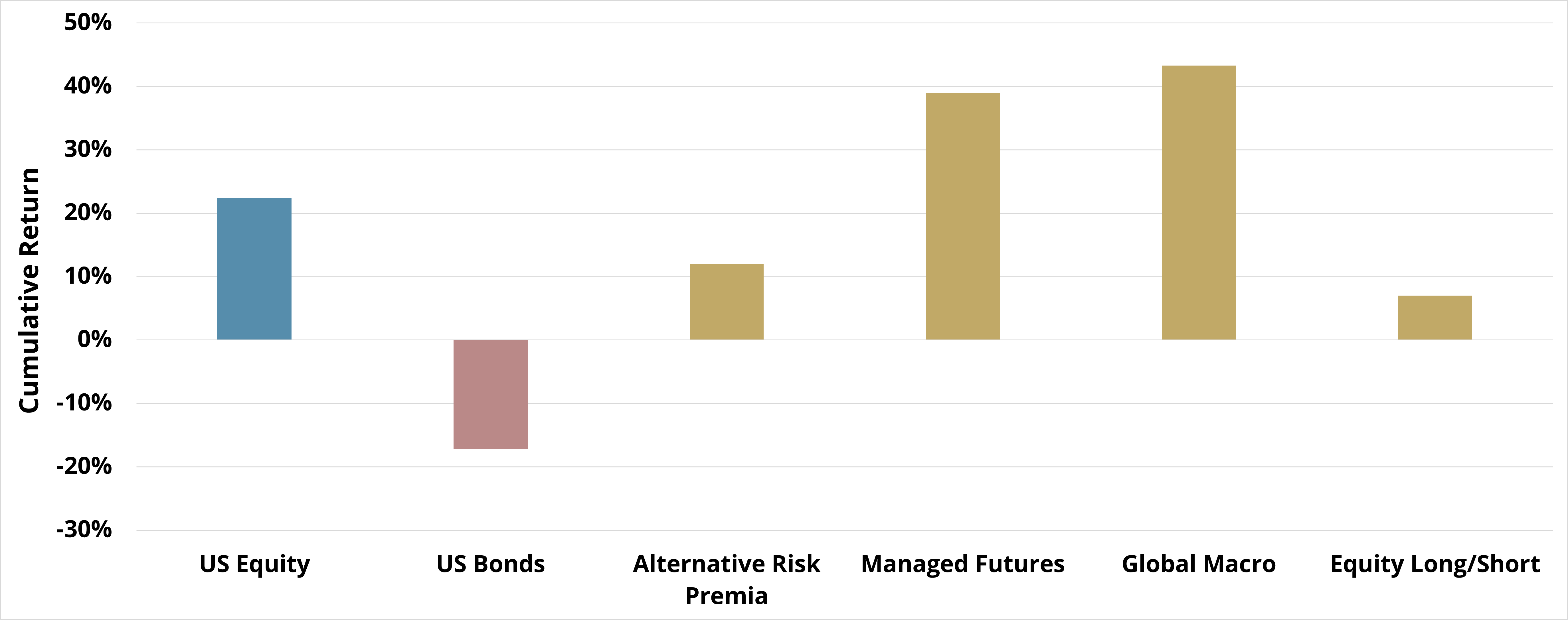

Liquid alts strategies have provided much sought after diversification benefits at times when they’re most needed in traditional portfolios. When inflation reared its ugly head post COVID, these strategies helped ballast the losses in fixed income portfolios, demonstrating the diversification benefit of using non-traditional asset classes.

07/31/20 - 10/31/22

But how exactly do alts generate superior risk-adjusted returns? The key lies in their approach to capturing alternative sources of returns that have exhibited low correlations with traditional asset classes.

Going Beyond Traditional Risk Premia

Traditional asset classes (e.g., passive, long-only stocks or bonds) provide exposure to equity or credit risk premium. Alternative investments seek to harness differentiated risks known as alternative risk premia, a dynamic and systematic source of return that behaves differently from those in traditional markets.

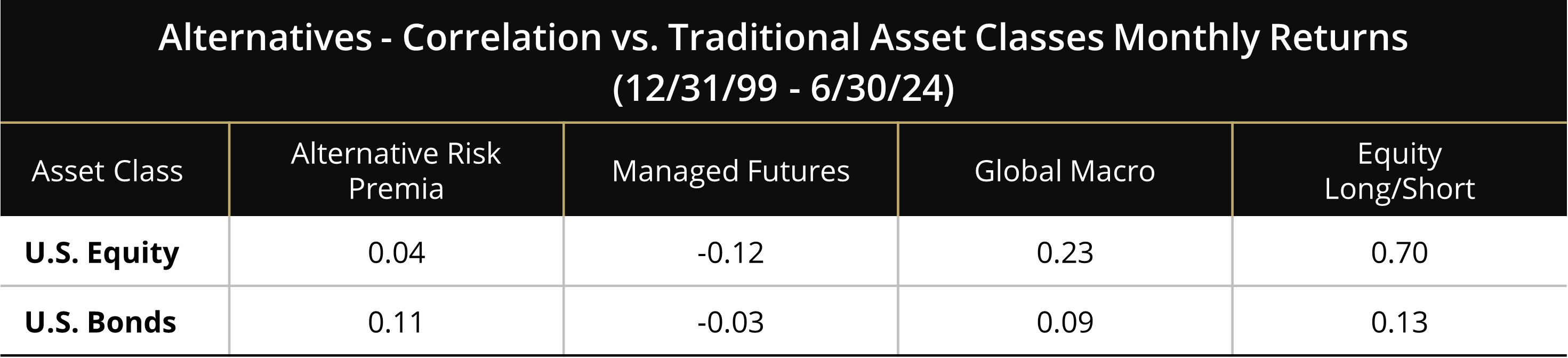

These strategies require active management and specialized expertise to execute effectively. One of the key benefits of alts is the diversification benefit within a holistic portfolio. Figure 5 outlines the monthly return correlations of a variety of indexes that track alternative investment approaches versus traditional asset class benchmarks.

Alternatives vs. Traditional Assets

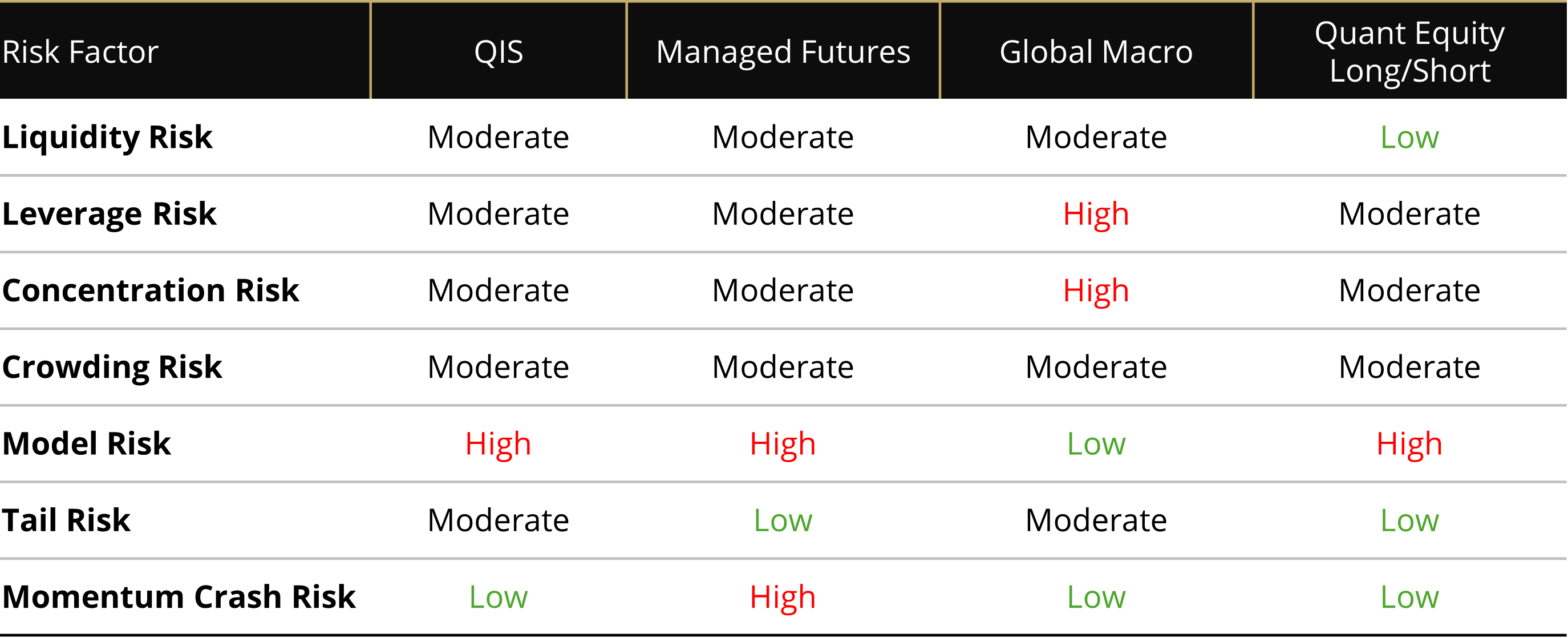

Understanding the Risks Accepted for Compensation in Alternatives

While the potential benefits of liquid alts are attractive, it's crucial to understand the unique risks they introduce into a portfolio. The below table outlines a set of common risk factors across a selected subset of hedge fund strategies along with a qualitative ranking of how the risk factor applies to the strategy.

Alternative Strategies

Let's examine each of these strategies, their associated risk factors, and how one should expect to be compensated for the unique risks associated with each strategy:

1. Quantitative Investment Strategies (QIS)

QIS encompasses a wide range of approaches, from defensive to carry-oriented strategies. Given this diversity, it's challenging to generalize the risks. However, some common risk factors include:

Risk Factors

- Tail Risk: Non-normally distributed returns can lead to unexpected, large losses

- Correlation Risk: Strategy correlations may become unstable during market volatility

- Crowding Risk: Popular strategies can become overcrowded, potentially amplifying losses when positions unwind

- Counterparty Risk: Many QIS strategies rely on OTC swaps, introducing counterparty exposure

- Backtesting Bias: Strategies may be vulnerable to overfitted backtests that lack robustness in live trading

Compensation for Risk

- Provide uncorrelated returns, offering diversification from traditional assets

- Efficient access to non-traditional betas and risk factors

- Ability to target specific risk factors for optimal trade expression

- Alternative source of income not directly tied to interest rates or fixed income market

2. Managed Futures

Managed futures strategies, also known as CTAs (Commodity Trading Advisors), aim to capture trends across various asset classes. Key risks include:

Risk Factors

- Volatility Risk: These strategies often exhibit higher than average volatility compared to traditional assets

- Reversal Risk: They may struggle to provide protection against sudden, short-lived market moves where a clear trend hasn't developed

- Manager Risk: The highly active nature of managed futures makes manager selection crucial

Compensation for Risk

- Long-term track record of positive returns similar in magnitude to equities

- Historically low correlations to traditional asset classes

- Strong historical performance during equity bear markets

- Potential to reduce overall portfolio risk due to low correlations, despite exhibiting higher volatility

3. Global Macro

Global macro strategies take positions based on broad economic and political views. Unique risk factors include:

Risk Factors

- Geopolitical Risk: Political events or policy changes can rapidly alter market conditions

- Macroeconomic Forecasting Risk: Incorrect views can result in significant losses

- Concentration Risk: Managers may take large, concentrated bets on specific themes

- Timing Risk: Even correct macro views can lead to poor returns if trades are not timed properly

- Operational Risk: Complex strategies require sophisticated infrastructure and risk management systems

Compensation for Risk

- Exposure to diverse asset classes and global markets, providing uncorrelated returns

- Ability to capitalize on macroeconomic trends and dislocations across various markets

- Flexibility to shift between long and short positions, potentially generating positive returns in both bull and bear markets

- Potential for "crisis alpha" during periods of extreme market stress or economic upheaval

4. Quantitative Equity Long/Short

Quant equity long/short strategies use systematic models to identify attractive long and short positions in equity markets. Key risks include:

Risk Factors

- Directional Risk: Maintaining true market neutrality is challenging and can lead to unintended market exposure

- Crowding Risk: Popular trades can become overcrowded, exacerbating volatility when positions unwind

- Short Squeeze Risk: Rapid price increases in short positions can force unwinding, leading to losses

- Idiosyncratic Risk: Unexpected company-specific events can cause outsized losses in concentrated positions

- Factor Exposure Risk: Unintended exposure to systematic risk factors can be mistaken for alpha

Compensation for Risk

- Access to uncorrelated return streams driven by manager skill in stock selection

- Asymmetric return profile that can profit from both rising and falling stock prices

- Potential to mitigate portfolio losses during equity market drawdowns through short positions and dynamic exposure management

- Capacity to quickly adapt to changing market conditions and capitalize on short-term mispricing

Conclusion

Alternative investments can play a valuable role in a well-diversified portfolio, potentially improving risk-adjusted returns and providing much-needed diversification in challenging market environments.

Alternative investments offer compelling opportunities to enhance traditional portfolios, but they come with unique risks that require careful consideration. By understanding these risks and how one is compensated for them, investors can make informed decisions about incorporating alts into their portfolios. As with any investment strategy, proper due diligence, risk management, and a clear understanding of one's investment objectives are crucial.

The world of alternative investments can be overwhelming given the complexity and choices. Working with experienced professionals and conducting thorough research can help to demystify this growing asset class, to help more resilient portfolios for tomorrow.

2 SEC.gov | Use of Derivatives by Registered Investment Companies and Business Development Companies: A Small Entity Compliance Guide

| Asset Class Proxies | Index |

|---|---|

| US Equity | S&P 500 INDEX |

| US Bonds | Bloomberg US Agg Total Return |

| Managed Futures | SG CTA Index |

| Global Macro | Credit Suisse Global Macro Ind |

| Long/Short Equity | Credit Suisse Long/Short Equity |

| Alternative Risk Premia | Bloomberg GSAM Cross Asset Risk |