Equity

Equity

How to Protect Your Equities Against Rising Rates

Introduction

Equity valuations are most vulnerable to rising rates when starting yields are low, which is why now is a critical time to consider a rate hedge for equity portfolios. In the discussion that follows we review the sensitivity of equity multiples to changes in the discount rate, demonstrating an extreme inverse relationship between rates and equity multiples when yields are low. We then present evidence that this relationship is most pronounced with longer dated rates. Finally, given this highly sensitive relationship, we discuss how adding an options-based rate hedge focused on longer dated rates has the potential to protect equity portfolios.

Rate Sensitivity of Equities: Theory

Assuming constant earnings growth and inflation, equity prices are proportional to earnings and an inverse discount rate:

The price earnings multiple is then just proportional to one over the discount rate, which is loosely the number of years of earnings that are required for the investor to get back the price paid for the equity. Two things are clear as we look at this relationship; (1) as the discount rate drops, equity multiples rise and (2) this sensitivity of multiples to rates is inversely related to the discount rate.

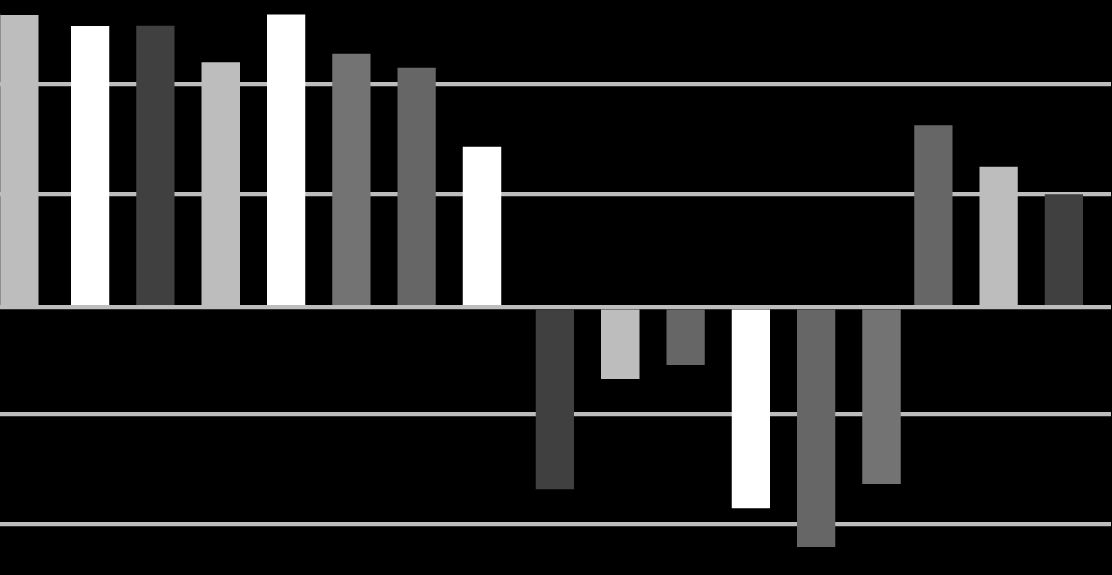

In Figure 1 we plot price earnings multiples and their sensitivity (earning multiple change with a +25bps rate move) at different discount rate levels (holding earnings constant). We note that as rates go down, the sensitivity increases.

Rate Sensitivity of Equities: Evidence

This theoretical relationship has played out in actual observed rates and price earnings multiples. Figure 2 looks at the history of the Schiller Cyclically Adjusted Price Earnings (CAPE) ratio for US equities and 10 year Treasury yields. The relationship is quite similar to the theoretical one shown above, with low rates associated with both high multiples and high sensitivity to rate changes.

This finding is particularly important given today’s conditions, where rates are low and equity multiples are high. As such, the sensitivity of multiples to rate changes is also likely to be very high. The red triangle is the current value (as of 9/30/2021). In this situation, a hedge against rising rates is likely to be a compelling addition to an equity dominated portfolio.

Refining The Hedge with Longer Maturity Rates

Next, we explore whether equities can be viewed as very long term, near perpetual bonds. For firms where long-term growth is an important component of valuation (much of the US Stock market), long-dated rates are particularly important. For these firms, valuations are heavily dependent on distant-in-the-future cash flows which are discounted at rates that are well beyond the 10 year rate that was deployed in Figure 2.

To highlight the importance of longer dated rates we examine the relationship between CAPE and the 30 year Treasury rate. When the 30 year rate is used in place of the 10 year rate in a regression, the R-squared jumps from 34% to 41%. When both the 10 and 30 year rates are used, the R Squared increases to 51%. These regression results suggest that interest rate hedges for equities that are driven by longer dated rates should be more effective than hedges based on the benchmark 10 year rate. And as discussed in the next section, long dated payer swaptions on long maturity rates are not only more effective, but also have a very attractive cost of ownership.

Adding a Rate Hedge to a Portfolio with Equities

We have seen that equity multiples depend in significant part on the level of rates, particularly longer dated rates, with higher and steeper curves being associated with lower price earnings multiples. As such, owning a hedge that performs well when the long end of the yield curve rises provides meaningful protection to a portfolio that contains both equities and bonds. The key to an efficient hedge is a strong response when rates rise, with only limited losses if rates are flat or go down. This is precisely the profile of the long-dated payer swaption on a long maturity forward rate.

Figure 3 shows the simulated value of a single Payer 7y20 swaption struck at a fixed rate of 4.25% as a function of rate changes over various horizons. As discussed in our swaption blog, there are three features of the USD rates and rate options markets that make this position so attractive. First, the yield curve itself is low and flat. This means that for scenarios in which the yield curve doesn't change, the underlying rate for this option has a very favorable flat to slightly positive roll. Second, the vol surface has a similar feature in that the underlying implied volatility used to price out of the money options also has a flat to slightly favorable roll. Third and finally, these options are currently priced at levels of implied volatility that are low relative to their historical distribution.

Parting Words

We have shown that equity valuations are highly sensitive to rate increases when starting yields are low, precisely the environment we find ourselves in today. We have also shown that equity multiples are most sensitive to increases in long dated rates, which are optimally hedged with long-dated payer swaptions.